Superstition Arbitrage

I am not superstitious by nature but 2023 ended for me with an omen that already could have foreshadowed a volatile 2024 for me. As I left my parents’ place after the Christmas Holidays to spend New Years’ Eve at home with my better half and my cat, I hit the flat wall enclosing the carport with the side of my Europoor Fiat Punto. No loss, since it isn’t worth anything. Nonetheless, it makes you think…

On my first day at work during the breakfast break, I then pulled the lucky Penny (Eurocent) from the New Year’s cake the wife of my boss baked for us (Greek tradition). I put it in my pocket and hoped for the best. However, I didn’t drink the sparkling wine and I didn’t burn the “Happy New Year” candles that came with it. Instead I stored them in my office for the time being.

A big mistake.

What followed were 11 months of personal life roller coaster (which I won’t comment on) and very volatile investment performance. My portfolio basically hit every possible pothole in the road, just like I hit that stupid wall on New Years’ Eve 2023.

Being heavily invested in Japan - BOOM - Japan mini-crash

Being heavily overweight EU - BOOM - EU still sucks

Being at some time 0% invested in US - BOOM - US has another banger year

Finally getting some buy signals for a few US stocks, e.g. UVE 0.00%↑ and SGMA 0.00%↑ - BOOM - Double Hurricane in Florida and delayed filing by SigmaTron.

Lingering between 0% and 5% CAGR in a year in which many of my peers celebrate 20%+ or even 50%+ returns, certainly hurt mentally, however, I finally reached the acceptance state and try to show gratitude for what I have and that I didn’t lose anything. Envy is a bitch.

At my final day in the office I then remembered the sparkled wine and the candles from January. I urged my coworkers that we should empty the bottle together and burn a candle, so that at least 2025 works out better (my colleagues also had also not the best year). I ended up drinking 2/3 of the bottle and left (kind of hammered) into the holidays during which burned the last candles.

Suddenly, my portfolio took up speed and then finally on the last trading day of 2024, luck shot VRME 0.00%↑ tripled pre-market on no news and saved my year. Whoever is pulling the strings of the universe, she or he has humor.

2024 Performance

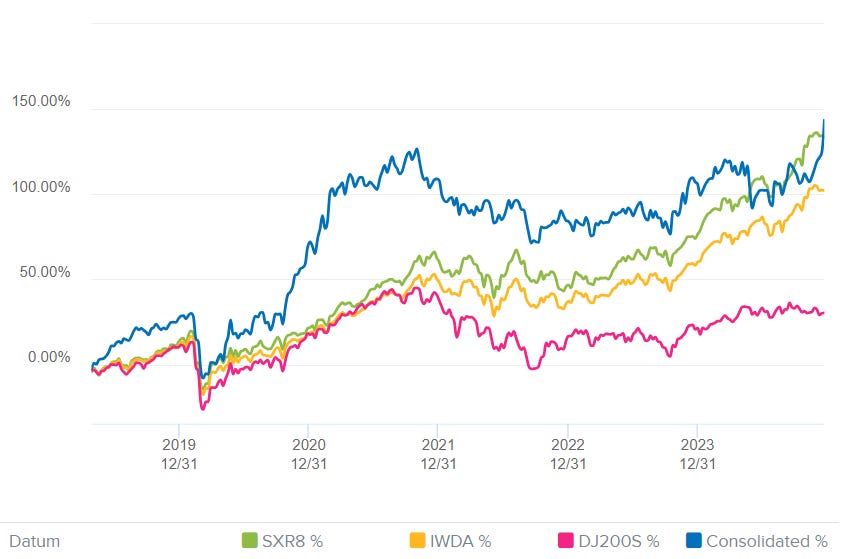

On the last meter and with a 2024 performance of 16.4%, I managed to catch up to global SmallcapValue UCITS ETFs like ZPRV (16.7%)and ZPRX (5.2%), which I usually like to reference (both in €, incl. Dividends).

As of today, the CAGR since the start of my quantitative “career” is now at roughly 17.5%. While this was enough to outperform most international Smallcap indices, we are still in the age of the almighty S&P500. I strongly believe that much of the S&P500 performance is unsustainable multiple expansion, which at some point will make the engine stutter. That’s why I think, that micro to SMIDcap value strategies which frequently “reset” multiples will come out ahead at some point in the future. Until then, keeping up with the S&P500’s pace and staying the course already wins half the battle imo. But most likely that’s just coping.

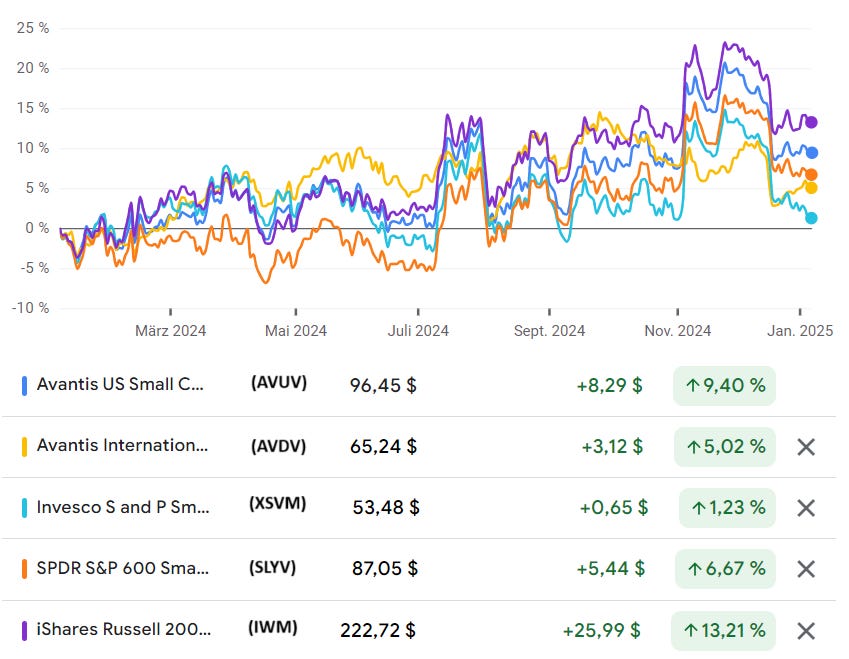

One has to admit that 2024 was not the best year for classic, broad smallcap value strategies, especially with an exUS focus. But even in US-only, Smallcap Value ETFs struggled against their benchmark, the Russell 2000. As you can see from the chart below, XSVM 0.00%↑ which combines Smallcap Value with Momentum criteria even underperformed the already weak “pure Value” peers.

So at least I can look in the mirror and say, 2024 was a difficult year. I would go even so far to say, 2024 has been exceptionally regarding wide outcome dispersion depending on small “design decisions” within you strategy. I am still waiting for the December Fama-French data to update my Data Explorer and investigate this in detail but here are some things I observed in 2024:

The recovery really stalled for Deep Value Smallcaps without a compelling narrative. Closely following analyst revisions and upcoming catalysts was key to separate winners from losers. And that’s usually only possible in more concentrated portfolios. From what I saw, focusing on broad operative Value plays generally underperformed. In contrast, special situations, turnarounds, narrative plays, etc. had a big year.

Usually, adding Momentum to your strategy helps to capture some of these concepts. But in 2024, a broad, rigid deep value momentum screen was littered with volatile names without clear direction in stock price and business dynamics. Deep divers looking in the second row beyond a simple screen had a blast in 2024.

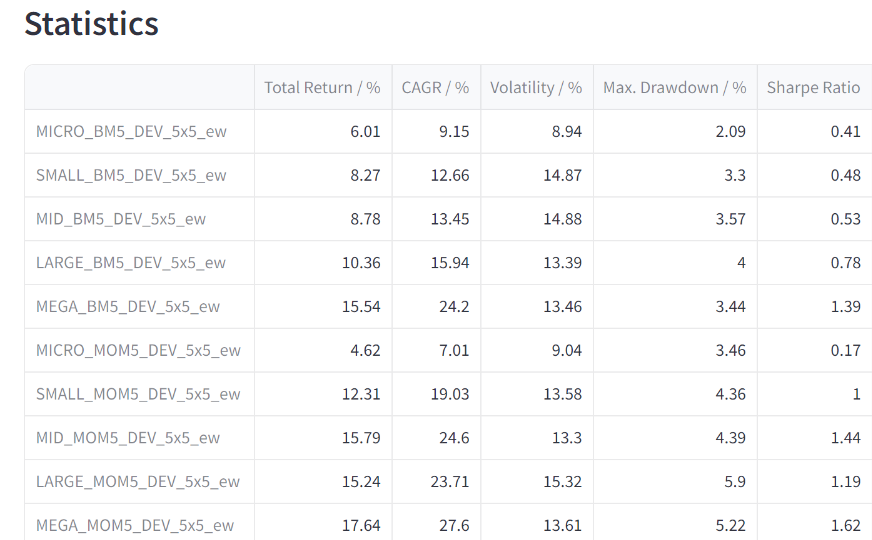

Both for Value and Momentum portfolios, it seemed like the already negative Size premium, which usually acts as an enhancer for other factors, made things even worse. I don’t have the full picture available now but this is how the Developed Market Size x HighValue (BM5) and Size x HighMomentum (MOM5) Portfolios according to Kenneth French looked in August. Completely upside down from what you’d expect (Factors long-term “work best” in MICRO and worst in MEGAcaps).

As a consequence, big cap-weighted SCV funds based on the Russell2000 (which contains stocks with over $10B in market cap) outperformed “true” SmallcapValue ETFs like DEEP 0.00%↑

If you were underweight US, you had a tough time. Everything exUS being much cheaper was a trap in 2024 (even though I don’t think it will be long-term). I and others, who were rather agnostic to “regional allocation”, fell into this trap. Quant researchers like Matthias Hanauer warned me in the past to let country allocations ride to freely, especially when it comes to US allocation. I should have listened.

Overall, I was able to track my benchmarks which I tried to replicate: The Developed Microcap Value and Momentum Sort Portfolios as described by the Ken French Database. Nonetheless, 2024 left a bad taste in my mouth.

To replicate really simple factor strategies like I did in the past, a data provider like Gurufocus, TIKR or quant-investing.com is sufficient. And I am really thankful that these tools helped me to achieve my goals over the past 5 years. Nonetheless, I think more can be done to turn the weaknesses of retail investing into strengths.

2025 changes

The biggest change for my process in 2024 was switching my data provider. I now fully integrated my research and screening process into Portfolio123. I tested Portfolio123 in 2021 with a cheap special offer to backtest some basic design questions of my strategy regarding Turnover, tolerance bands, weightings etc. However, I did not stay with P123 at this time because of several reasons. My last data provider (quant-investing.com), gave me all I needed (and more). For the fraction of the cost, I got worldwide coverage (incl. Asia) of factor data, which I could download daily and process as usual with my own R script. At least so I thought. However, I was not able to reproduce what I learned from my P123 trial.

Don’t get me wrong, I don’t blame QI for this. I simply made the mistake to think that I can take the conclusion from one data source and 1:1 adapt it in a process using a different (cheaper) data source. As mentioned before, to replicate a broad well-known slow-moving factor strategy, this is totally fine. However, the more concentrated and high-turnover you trade, the more the devil is in the detail.

Imo Portfolio123 is simply much faster, more transparent regarding primary data sources, which results in higher data quality. Also the backtesting tools allow to quickly check small design choices for their merits (of course always with the risk of overfitting, so never go to deep into the woods!).

My main approach, Microcap Value Momentum, and also the rough importance weighting for those features remain the same. Evidence for this was that during the migration I could keep most of my portfolio names at the time.

However, here are some details on what modifications I implemented over the past months and going into 2025 (I am still in transition so this list might be not 100% final):

I ditched my Japan exposure, which is unfortunate because I really liked investing in those weird super-cheap companies. E.g. JVCKenwood $6632.T was one of my biggest winners of the last 2 years. But Portfolio123 does not cover Asia (yet), so I have to pass for now.

Finally giving in to the fact that regional diversification matters, I separated my US exposure and exUS exposure into two different (but 90% similar) strategies. As for now, I will target a fixed 40% US allocation with ~10 names and 60% exUS allocation with ~15 names (exact numbers may change). This splits my microcap universe roughly in the middle (as there are much more stocks listed in US). In the long-run, literature and my own research suggests that it doesn’t matter that much for raw returns if you have a fixed or variable allocation to US/exUS. But there seem to be some diversification benefits (Sharpe Ratio increases) and, as I learned the hard way in 2024, mental stability benefits :D

I further diversified my Value Composite, which remains the vast core of my strategy. To keep it robust, I weight every ratio within the Composite equally. However, P123 simply gives me a broader set of formulas and raw data to work with, so I added Forward EPS and FCF Multiples as well as Gross Profit / EV amongst others. Furthermore, instead of only comparing all stocks in the universe cross-sectionally, I added a within-industry comparison.

To my basic stock momentum composite, I added a fundamental momentum composite which contains the classic Piotrosky F-score, some trailing growth components, analyst revisions and EPS Surprises. Main reason? Because with P123, I can! And this was a huge blind spot for me in the past. Classic Momentum signals fading can take months, fundamental momentum helps finding inflection points and works much faster. It basically serves as a “Kicker Signal” to confirm an existing High-Value-Momentum Situation.

In my stock universe, I now actively exclude Financials, Consumer Defensive and Utilities. Financials mainly because of the accounting messing with the signals. Consumer Defensive mainly because they have more bond-like characteristics and thus won’t work that well with momentum (they still work great but they usually start making the top of the screen when you should start loading the boat with high-beta names instead). For Utilities, it’s a mix of the two. Currently, I am considering building an additional low-vol strategy which just buys defensive sectors. But for now, I just keep them separated from the degen names.

I adjusted my ranking tolerance bands to match about 200% annual turnover (6 months average holding period).

For now I won’t throw around P123 backtests to not give the wrong idea. I still need time to digest the migration to the platform, although I really feel at home. The tools are amazing, the portfolio tracking is really simple and you can customize every little detail. For that alone, I regret not switching earlier.

The changes above also might sound to you - as an objective observer - like a coping mechanism, overfitting, recency bias… And I don’t blame you, even though I do my best to not fall in the classic quant traps, I can’t tell 100% that I won’t.

So far, since the switch, my portfolio finally started moving again. As I am writing this, my portfolio is up 5% YTD, bringing my 1-year performance up to 23% with all of coming in the last 2 months. Today LFVN 0.00%↑, one of my US picks, is up 25% on preliminary numbers and raised guidance. Without Portfolio123, I would have never found my current top performers. So for now, I have reason to believe that it will be alright. My mental hedge against doubts is the following: I did not styledrift at the core. I am still a global Value-Momentum-Microcap Investor. The main thing that changed is that I switched to a higher-quality data provider. And how bad can that be?

My Current Portfolio

Finally, I want to show you my current portfolio. I won’t comment on the single positions for now but I toy with the idea of giving frequent snapshots of top-screening single names in the future. This might serve as starting point for readers’ idea generation. Please keep in mind that my annual turnover target is 200%. This means the average stock is held for 6 months before the signals decay below my ranking threshold. However, on an individual stock basis, the holding period can be much lower, depending on news, performance, market environment etc.

USA:

exUS:

Thank you for reading!

I trade Australian micro and small cap equities using a multi factor model, but determined trading costs are too high to include momentum.

I'd be surprised if this were not the case for US equities too. How do you estimate trading costs?

Great read thanks.