Don't Catch Falling Knives

Buying in the 52-week low list, looking for “bargains” based on bad recent stock price performance, winning by going against the crowd… Many investors have the deep contrarian desire to catch a falling knife and make a killing by nailing the turnaround. It worked in 2009 and now at the beginning of 2023. Buying the most bombed out stocks at the bottom of “brutal” market drawdowns was very lucrative. So should you do it?

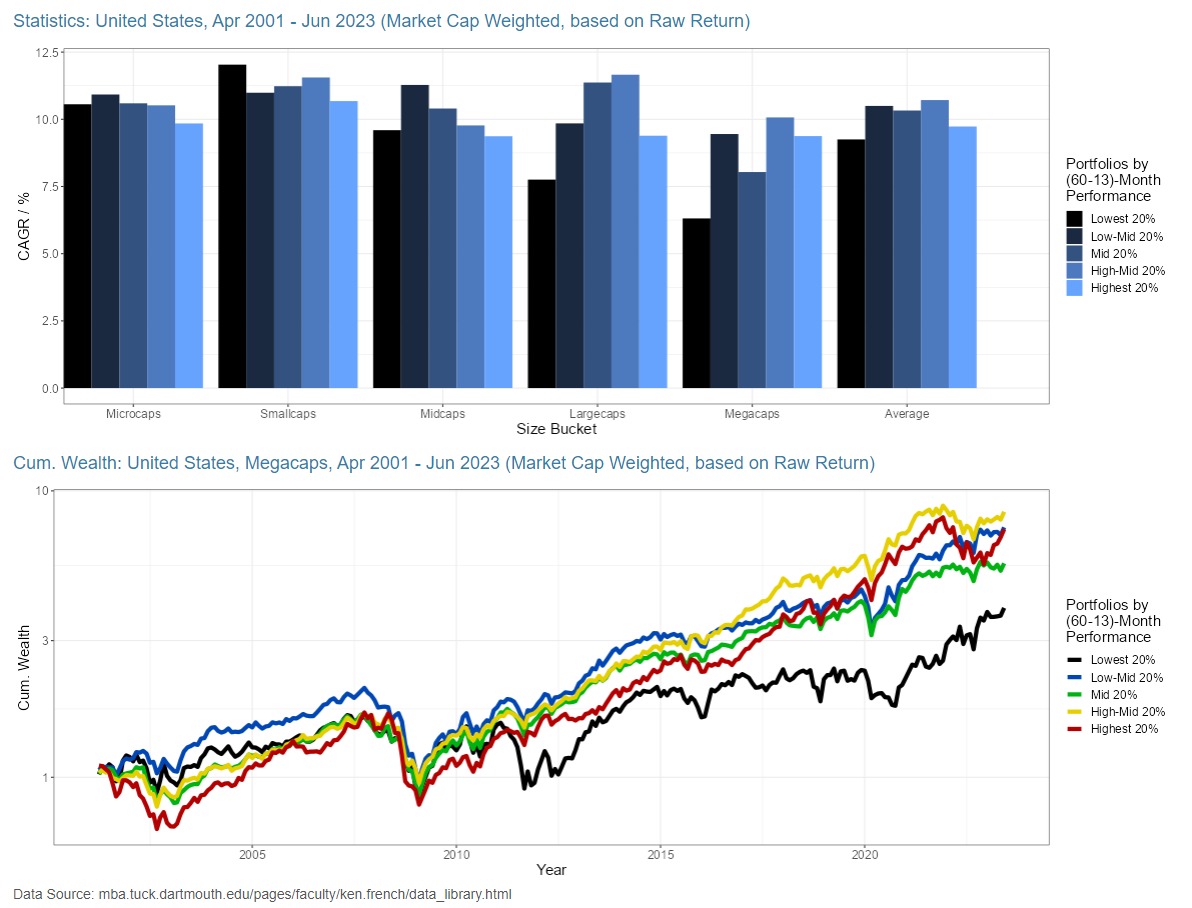

We will look at 5 different Momentum buckets in 5 Company Size buckets at the bottom of those 3 bear markets and around those periods. To start out, let’s have a look at Developed markets momentum strategies in the long-term. The bar chart compares the CAGR of all the buckets. The cum. wealth plot shows exemplary charts in the megacap space. The layout will be the same for the analysis in later sections. All charts are made with my personal new webtool (R + shinyapps) for visualization of the Ken-French database. Hopefully, I will be able to make it available to you online soon:

As we all know and can see here easily, catching falling knives (systematically buying the lowest-momentum stocks) is a bad idea. You now might say “Yeah but that implies that I would sell if one of my falling knives becomes a winner and I would replace it with a new falling knive”. You are right but I would say that many investors do exactly that. Especially if a loser keeps on losing after the buy, the desire for a quick break-even becomes the main focus and when the stock is finally starting to recover, many investors rather take the profit and look for new opportunities. Also, if an investor looks for “bargains” based on bad recent performance only, he most likely already has a new watchlist of losers and will take the “opportunity”. But can you make it work?

GFC

Here you see the performance of momentum buckets in the year following the bottom in March 2009:

An impressive quick double for loser megacaps from the bottom. In smaller stocks, you could have even reached almost 150% CAGR and that with a basket approach! Imagine selective stock picking within those baskets and you could have made a killing with a few multibaggers. So should you? Let’s look at the 4-year period centered around March 2009 instead:

If you started buying losers before the crysis, you gained nothing but grey hair.

Today

Let’s now have a look at YTD (unfortunately the FF data is only available up to June 2023 for now):

40% gains in previous-loser megacaps until end of June (over 90% CAGR). Not bad. Even large-, mid- and smallcaps participated in the loser rally. Only microcap losers kept behind. So what if we now include the whole post-COVID era?

Again, buying laggards gained you nothing but additional volatility. If you were a microcap investor, you did much worse ignoring momentum:

Conclusion

Don’t buy stocks only because they are in a 80% drawdown. Many of them fell for a reason. You can make a killing if you time the bottom in a bear market but being a few months too early or too late can kill the whole benefit while maintaining all the volatility.

At this point I actually also wanted to recommend maybe looking at long- and short-term reversals. But these strategies suffered greatly over recent decades. See here:

In my opinion, there was a shift for reversal factors making them more of a volatility signal (both extremes are bad). They can still work in Small and Micro but to be honest, there are better (fundamental) ways to be contrarian.