Equal-Weighted vs. Cap-Weighted: In which Styles and Factors did it matter for CAGR?

There is always a big debate if you should look at factors in an equal-weighted construction or in a cap-weighted construction. Cap-weighted construction is the go-to for ETFs as it is more cost-efficient and basically self-adjusting. No rebalancing is needed, only reconstitution of the portfolio holdings based on the rules of the style, be it momentum, value or any other. On the other hand, most (more concentrated) retail investors tend to build portfolios in an equal-weighted manner because most trading frictions are of much lower concern. So, the question is: For which styles does it matter?

If equal-weighting does not outperform cap-weighting, this eliminates the need for rebalancing. Furthermore, one might question the whole premise of DIY stockpicking in this case and going for a cheap style ETF instead might be prefered.

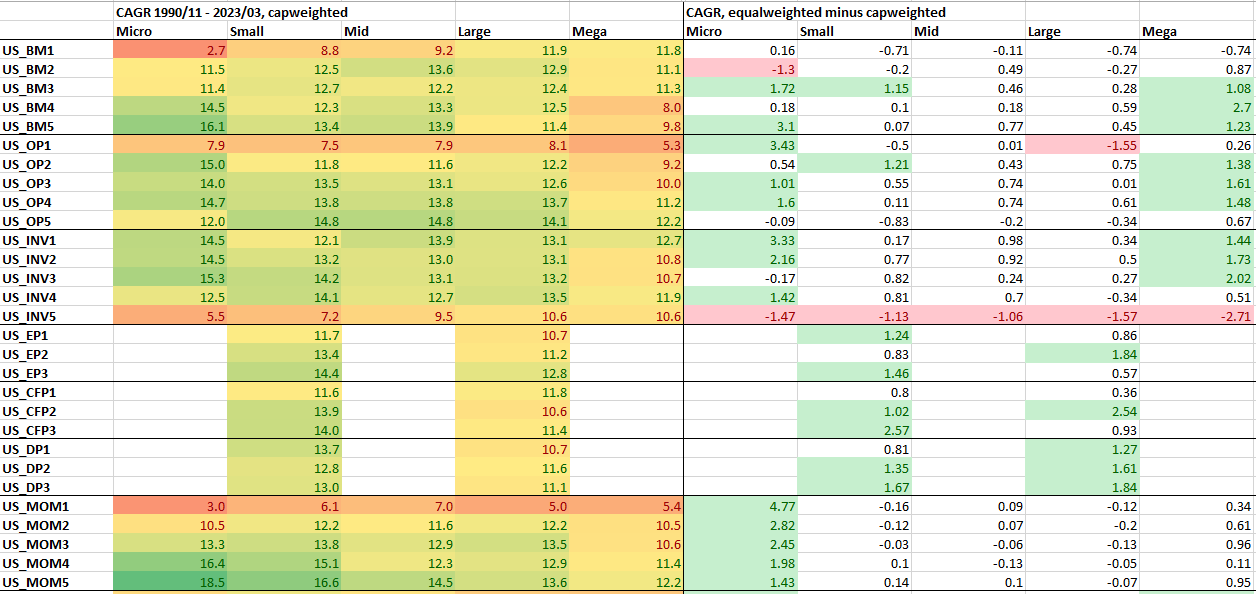

In the following, I will show the CAGR data from 5x5 size_factor sort portfolios from the FF database. Data is from 1990/11 to 2023/02. On the left, you will see the normal cap-weighted CAGRs of each portfolio. On the right, I will show the CAGR difference between Equalweight and Capweight with absolute values > 1 marked accordingly.

I have the data for also calculating Sharpe Ratios but showing these would break the mold. Maybe I’ll add these tables later in an addendum post.

Classic US Factors

These are all monthly US portfolios with

BM = Book-to-market from 1 (low 20 %) to 5 (high 20 %)

OP = Operating Income / Equity from 1 (low 20 %) to 5 (high 20 %)

INV = Asset Growth from 1 (low 20 %) to 5 (high 20 %)

EP = Earnings / Price from 1 (low 33 %) to 3 (high 33 %)

CFP = Cashflow / Price from 1 (low 33 %) to 3 (high 33 %)

DP = Dividends Yield from 1 (low 33 %) to 3 (high 33 %)

MOM = 12_2 motnh Momentum from (low 20 %) to 5 (high 20 %)

EP, CFP, DP only exist in 2x3 construction within the dataset unfortunately .

Findings:

Equal-weighting in Micro improved returns across the board because of nanocaps as the main driver. So one could say that a retail investor should try to go as small and equal-weight as possible and only as large as necessary based on spreads and liquidity needs.

Equal-weighting is an amplifier which cuts both ways, see e.g. INV5. A bad style might get worse if equal-weighted.

In pure small, mid and largecap portfolios, it did not really matter. So in these areas on might be better off with cap-weighting (costs).

In portfolios including megacaps, equal-weighting was able to improve Value, Quality and Investment styles. You could argue that especially Value does not work well in megacaps and will overweight large Value Traps.

In US momentum (ex microcaps), the weighting scheme did not matter much at all.

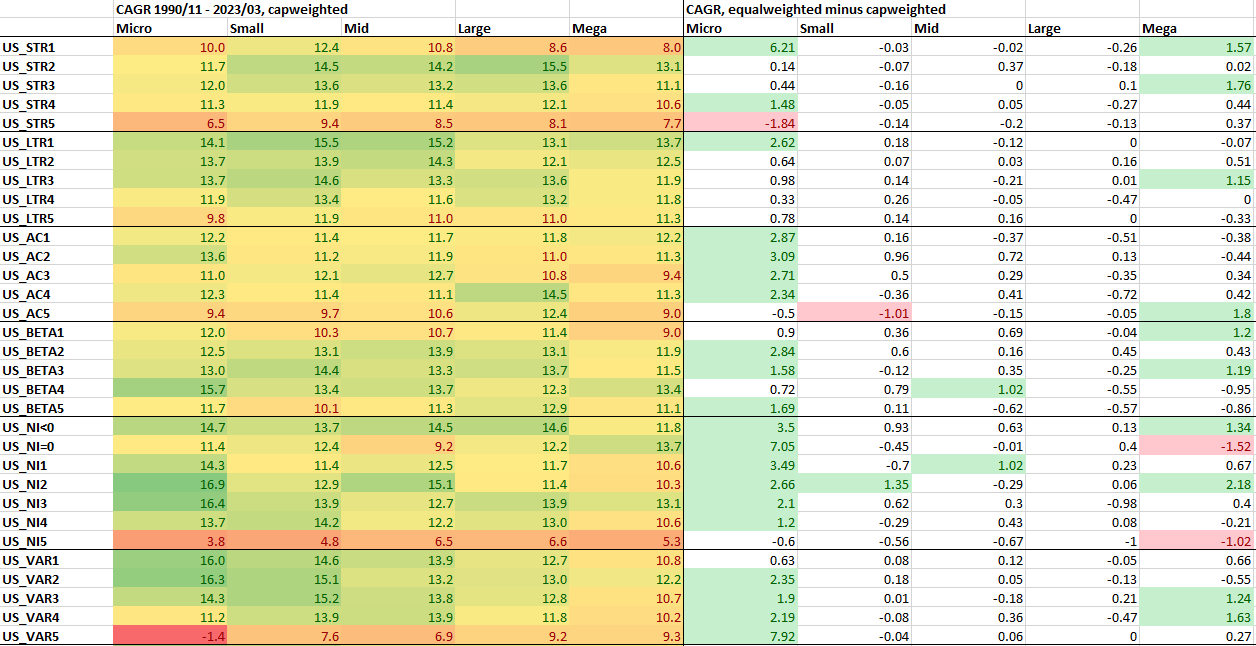

Other US factors

There are other US factors which I will cover here.

STR = 1-month total return from 1 (low 20 %) to 5 (high 20 %)

LTR = 60_12-month total return from 1 (low 20 %) to 5 (high 20 %)

AC = Change in oper. working capital / Equity from 1 (low 20 %) to 5 (high 20 %)

BETA = 60-month beta from 1 (low 20 %) to 5 (high 20 %)

NI = 1-year net stock issuance <0, =0 and from 1 (low 20 %) to 5 (high 20 %)

VAR = 60-day stock return variance from 1 (low 20 %) to 5 (high 20 %)

Findings:

Equal-weighting in Micro improved returns across the board, again, mainly because of nanocaps as the main driver. The effect was strongest for STR1 (which is hard to trade in nanocaps), low stock issuance and (surprisingly) in VAR5 (however, this is mainly making the disastrous returns of it a bit less disastrous).

Ex microcaps, the results are a bit underwhelming. VAR+STR+BETA trading in megacaps with an equal-weight approach might be interesting due to the improvement in an overall high-liquidity basket. But just buying a MinVol or LowVol ETF might be more efficient nonetheless.

My naive conclusion:

Ex Microcaps, trading non-traditional factors outside of cheap, cap-weighted ETFs is not worth it.

Global Developed Market Factors

These are all monthly Developed Markets portfolios (Europe Developed, US, Canada, Japan, Australia, Hong Kong, NZ, Singapore) with

BM = Book-to-market from 1 (low 20 %) to 5 (high 20 %)

OP = Operating Income / Equity from 1 (low 20 %) to 5 (high 20 %)

INV = Asset Growth from 1 (low 20 %) to 5 (high 20 %)

MOM = 12_2 month Momentum from (low 20 %) to 5 (high 20 %)

The picture remains the same as for traditional US factors. Microcaps profit from equal-weighting, as well as megacap value and quality. Megacap momentum also was improved. The stronger effect might originate from the strong distortion of megacap definitions across borders. So in global investing, equal-weighting might have some benefits but, as I described in my last posts, the weighting of separate regional portfolios is a whole other question.

Conclusion

If there is a proper cap-weighted ETF available, buy the ETF. This is especially the case for US large- and midcaps. Megacaps might distort the portfolio, so if there is a version with a max. allocation cap for single holdings or an equal-weight version, go for it. Especially, in Styles with a Value tilt. DIY trading of a traditional largecap factor book might make sense if you run a concentrated, integrated multi-factor strategy but not for single factors. There is just too easy access today.

So you might want to swim, where the big sharks can’t. In microcaps, the returns are much juicier and proper ETFs are rare or non-existent. So if I go for style stock-picking, I want to go as small as possible and I want to equal-weight.

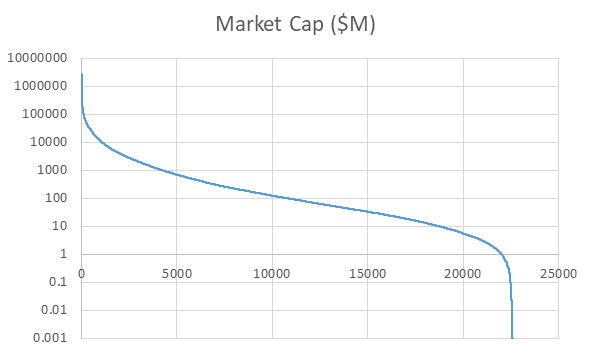

But… Where is the big EW-CW divergence in megacaps and microcaps coming from?

Well, there is at least one simple answer to it: The market cap span in each bucket. The FF size buckets are constructed based on NYSE (or any other global exchange) breakpoints. The current marketcap averages in the 5 size buckets are approximately as follows:

That means that the span between the largest and the smallest holding in the 3 middle size buckets should be consistently below a factor of 10 for cap-weighting. Unfortunately, Let’s say the smallest holding in “Small” is $800M and the largest one is $2400M. That’s only a factor of 3x and not toooo far from equal-weighting.

However, in microcap and megacap land, the picture is much more extreme. The factor between a $1M stock (and there are smaller ones) and a $300M stock is 300. Same goes for a $50B stock and a $2000B stock (factor 40).

I have over 20000 global stocks in my screen and in this universe, the market cap distribution clearly follows an S-shape:

Megacaps distort portfolios often in a negative way but are overweight in every major fund or ETF. Nanocaps distort them in a positive way but might not be tradeable. The middle ground doesn’t care too much.

Is there a big lesson here? I don’t know. I think the main conclusion is that one should always have an eye on the underlying universe, the underlying market cap spans and how this might affect the thing I want to achieve. From there I can decide if I should go with the standard ETF, pay a bit of extra fees for equal-weighting, allocation caps or similar or if I should go the DIY route.

I could imagine buying cheap largecap Momentum/LowVol ETFs with half of my equity allocation and trading multifactor microcaps with the other half. For now, I do microcaps-only but this “barbell” approach might be especially interesting if I ever hit a certain scale and/or liquidity ceiling.