Global Smallcap Value Investing And The Question Of Regional Allocation

The Question

In my last post, I looked at the impact of different regional allocation decisions on global smallcap momentum strategies and tried to draw conclusions from the analysis which could also be relevant for global stock picking based on momentum. Of course, timing regional momentum strategies based on their relative momentum seems kind of redundant at first. Also, I don’t even run a pure momentum strategy but a multi-factor strategy. Nonetheless, the exercise taught me some things.

The next interesting question is the same for Smallcap Value strategies: “Is is better to maintain a certain regional allocation and treat regional value portfolios as separate components or should I time regional allocation depending on regional momentum.

Fixed Allocation

To do some tests, I downloaded the return data of 5x5 Size-Value sorts (cap-weighted) from the Ken French Data Library for Developed Markets, North America, Europe, Japan and Asia ex Japan. Value in this case means simple high Book-to-market (HML factor long leg). For each region, I extracted the Smallcap-HighValue corner portfolio.

The Developed Market Portfolio as published by Fama-French ranks regionally and puts all qualifying stocks back together into one portfolio. Depending on the weighting scheme (cap-weighted or equal-weighted), the resulting country allocation highly depends on the number and size of single stocks in each region. Here is the region categorization according to the database:

In comparison to the original Developed Markets Portfolio, I also created a own equal-weight portfolio allocating 1/3 to North America, 1/3 to Europe and 1/3 to Asia (50/50 Japan/exJapan).

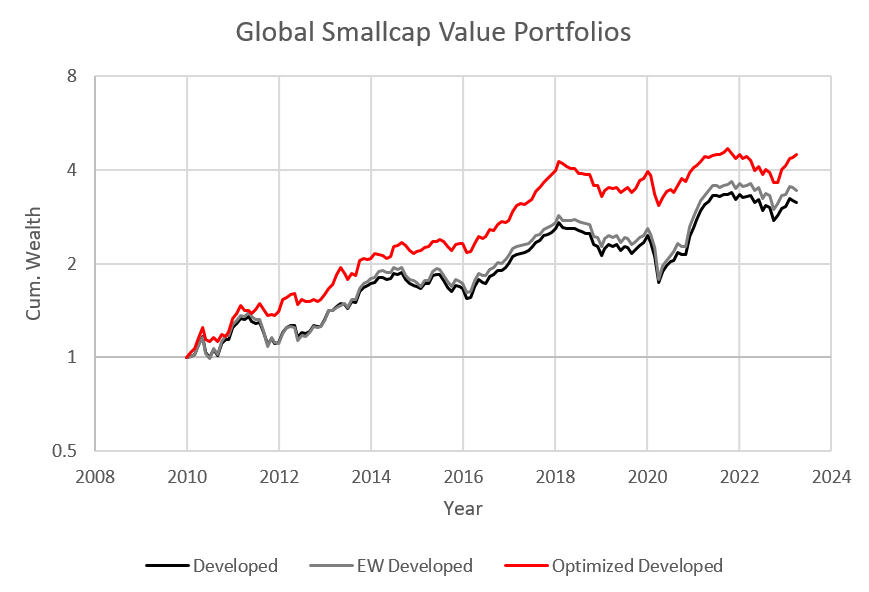

Here is the cumulative wealth chart:

As in my momentum post, the EW portfolio comes close to the Fama-French Developed construction but gets dragged down a bit by the Japan and Europe overweight. So equal-weight continental allocation is a good starting point for Smallcap Value as well.

Let’s now again have a naive look into optimized (fixed) regional allocation regarding risk-adjusted returns. If we solve for maximum risk-adjusted returns in the given time frame, we get the following “optimal” global Smallcap-Value allocations:

Full Dataset:

North America 56%, Europe 4%, Japan 11%, Asia ex Japan 29%

Since 2010:

North America 12%, Europe 0%, Japan 83%, Asia ex Japan 5%

Contrary to the Japan Smallcap-Momentum portfolio, Japan Smallcap-Value both outperformed other regions and was much more stable between 2018 and 2021. As a result, the optimum Japan allocation for the full dataset since 1990 was 11%, whereas since 2010 is would have been 83% (!). This shows that, even for Value allocations, deviating from equal-weight allocation to create an “optimized” fixed regional allocation is similar to playing roulette. The winners change over the decades and favoring one region based on a multi-year optimization will almost certainly be disappointing. Again, other possibilities with a reasonable anchor would be weighting by total market cap (global asset allocation portfolio), by GDP or similar.

Momentum-Timed Allocation

In the next step, we try to find a better way to time the over- and underweighting of certain regions in the portfolio. If you apply a combines Value-Momentum approach, your system will look for cheap stocks around the world but will only pick the ones with high momentum. The resulting rotation and concentration in certain regions depending on the market environment should correlate with a momentum-timed allocation to our regional Smallcap-Value portfolios. As a proxy, I analyze the rolling 12-month performance of the regional Smallcap-Value portfolios to find the “winner” region in each month.

The resulting Smallcap-Value leaderboard over time looked as follows:

For comparison, this was the Smallcap-Momentum leaderboard in my last post:

So, the question now (again) would be if overweighting the prior winner region improved or deteriorated returns. To test this, we will compare the EW Developed portfolio to different momentum-timed portfolios.

In each momentum-timed portfolio, a different minimum allocation parameter (MAP) is applied. MAP ranges from 0 to 20. In each month, MAP % are allocated to each regional portfolio and the rest ((100 - 4*MAP)%) is allocated to the winner region to create an overweight.

Additionally, I created an “ExLoser” Portfolio, which excludes the portfolio with the lowest prior 12-month performance in each month and allocates 1/3 to each of the remaining 3 regions.

In a last step, I combined the two approaches to create an “ExLoser-OverweightWinner” Portfolio (0% Loser, 50% Winner, 25% each to the remaining 2 regions)

Here are the results:

We see basically a similar behavior as for the Smallcap-Momentum investigation:

A Momentum-timed approach increases raw returns and volatility

Increasing MAP leads to reduced volatility but diminishing returns

What’s different is that excluding the loser was much less important. The underlying Value construction already delivers the necessary downside protection. As a consequence, “ExLoser” and “ExLoser-OW” look very similar to “EW Developed” and “MT (MAP=20)”

The risk-adjusted statistics since the year 2000 look not much different, except for the surprising underperformance of “MT (MAP=0)”. That means naive momentum-timing of the regional Smallcap-Value portfolios was a waste of time and resources post-2000:

Conclusion

I have to admit that I expected more from this analysis. I thought taking Small-cap-Value portfolios and rotating them based on regional momentum will combine the best of both worlds and will boost returns significantly. However, the findings show quite the opposite. In fact, global allocation to Smallcap-Value seems to be much more “forgiving” than Smallcap-Momentum regarding the question of country allocation. If you want to invest globally and you have a pure Value mindset, Equal-weighting of regional Smallcap-Value portfolios might be both the easiest and the best way to allocate.

The “flaw” in my (hyped) initial thinking was that the momentum would also creep deeply into the chosen portfolios. However, if we construct 4 broad regional Value portfolios without additional information, the average momentum load of these portfolios will be rather low or neutral. Even if we than select the Portfolio with the highest prior performance, the effective momentum load will be very diluted compared to “real” integrated Value+Momentum stock picking approach, which only selects cheap high-flyers.

Nonetheless, I learned something: It is good to know that Value as a standalone doesn’t really care too much about regional momentum, especially post-2000. So there is no need to stress about countries too much. If you are a momentum investor (or a multi-factor investor using momentum), considering the effect of regional momentum is worth a thought to boost returns or reduce volatility (see my last post).

After this analysis, my broad view on global investing will remain as follows:

Individual stock properties > Sector properties > Geographic properties.

Especially in the age of globalized financial markets.