Portfolio State 2021-05-18

This post has the purpose of showing the current state of the portfolio. In the following list you see my current holdings:

I currently have a larger cash position of approximately 13%. The reasons are a) that my dynamic rebalancing approach needs some time to reinvest the latest gains in CitiTrends (~800%) and Arconic (~200%) and b) that my position in Ameriprise Financial was liquidated due to an acquisition.

Due to my positions in GBTC and BTCE, my portfolio took a hit during the latest Bitcoin sell-off. Still the drawdown in my portfolio to date is only ~3%. Here the latest 10month chart:

The stats of my portfolio are as good as they can get over a 1y lookback. As many financial professionals said: "Take a Screenshot of your current 1y-Performance. You won't get any better 1y return in your lifetimemost likely". A 3.58 Sharpe Ratio is a nice to have. But even a 1.23 since inception, including the 2020 crash is quite impressive (*taps own shoulder*). Of course there is timing luck involved. These figures include the fact that the 2020 crash happened in my first "test year" when I wasn't fully invested yet.

Here is my portfolio performance vs my benchamrks $IVAL, $IMOM and $ACWI. My return got a boost in late 2020 due to high-flying cyclicals and Bitcoin.

My current exposures to sectors is rather diversified but there is a cluster in industrials and cyclicals. I try to have not more than 25% in one sector. Furthermore, I avoid having more than 1 position in the same Country-Industry combination.

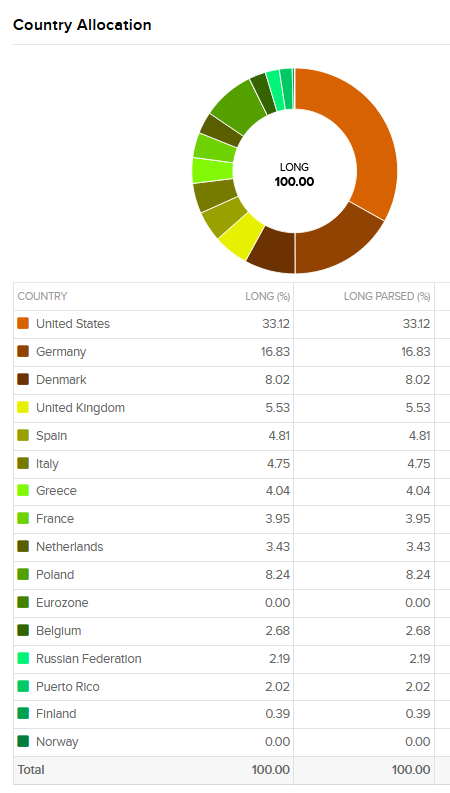

My current exposures to countries is 35% US/PuertoRico and 65% diversified Europe. So I am quite satisfied with the diversification across regions and currencies. I'd like to have more Asian exposure, but currently, few signals come in in this regard. One country which appears often in my screen lately is Poland.

Today a new rebalancing is due. The new investment cycle started at the end of April 2021 and we decided to switch from a 12m rebalancing cycle to a 6m cycle. We therefore will adjust one of the 20 positions each ~180/20 = 9 days from now on. Today, we will check, rebalance/sell the Ecros SA position.

I wish any readers a wonderful week.

You can send me feedback at Twitter @npidoney.

Cheers,

Your Non-Prophet