Portfolio Update April 2023 (explanations and excuses)

In this post I want to give a short portfolio update, even though not much changed recently. Who knows my pinned tweets, maybe already followed some of the transitions and trades over the past few months. I want to summarize shortly what I have learned in 2022 and beyond.

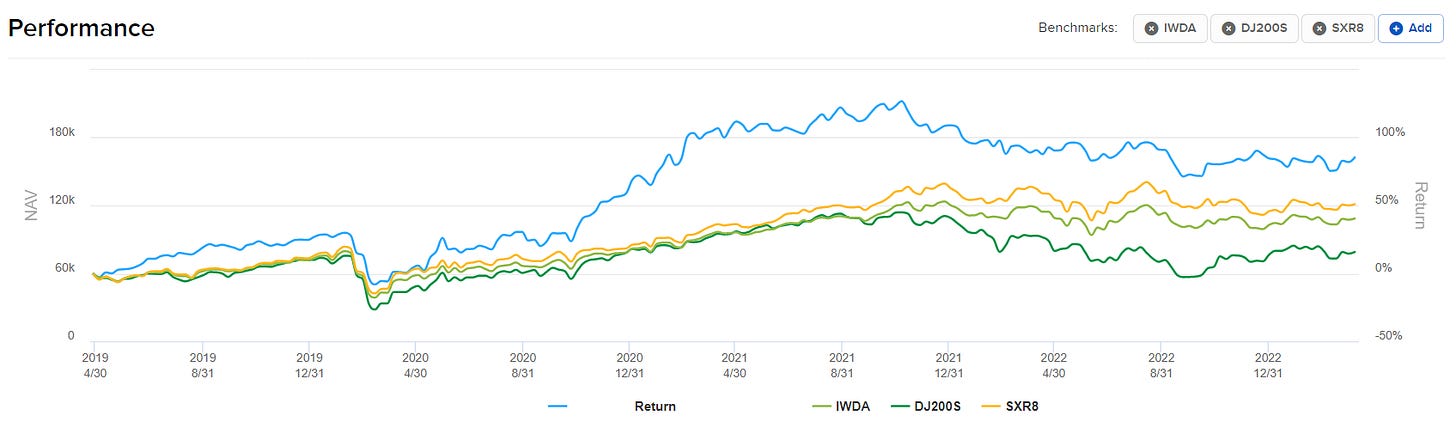

Overall the time-series performance of my main account in EUR terms is still outperforming major benchmarks since I started my multi-factor strategy at the end of April 2019. So it has been almost exactly 4 years since then. My integrated Value-Momentum-Quality strategy was always the main chunk of my book even though I dabbled in different stuff along the way. Even though I can not say what the exact average performance and weight of all the side gigs was along the way, I can safely tell they lost me money in total, either directly or in the form of opportunity cost.

I had some lucky breaks (BTC ETN in 2020, some levered long swings in 2021) but the bad trades outweighed them.

After shorting the bullmarket in 2020 to “boost returns in an inevitable second downswing” (stupid),

I noticed that my system had a blindspot in China exposure, so I bought some “cheap” Chinese compounders in 2021 (stupid),

just to notice that maybe I was approaching things wrong and I should use trend-following to time market exposure into the 2022 turmoil (not so stupid) and hide in treasuries at the beginning of a historically fast inflation/FED-hike spiral (veeeery stupid),

followed by asking: “What about adding a long/short overlay to exploit the value spread supported by momentum/quality”, into an epic multi-factor reversal in January (stupid).

I can only imagine where I would stand now without those stupid side gigs. Fortunately, the exposure usually was <10% and I always ran my main strategy in the background. Who read earlier posts of me, knows that I wanted to quit doing stupid stuff. So if I wanted to try something, I at least tried stuff that has a proven track record and a fundamental basis for positive expected returns. But my timing sucked hard. China in 2021, bonds in 2022 and L/S factors in early 2023. It feels like the universe wants to tell me to quit experimenting. “Cobbler, stick to your trade!”.

My multi-factor strategy did not change drastically over the years. The main concept remains buying and holding a portfolio of 20-30ish stocks with the highest integrated Value, Momentum and Quality. I tweaked the composite constructions slightly from time to time in order to express new views on factor research e.g. regarding factor interactions, non-linear return profiles etc. Furthermore, I nowadays “punish” higher marketcaps in my process since I strongly believe in a smallcap outperformance over the coming decade and in higher factor persistence/robustness in micro/smallcaps. The former is based on current Small/Midcap valuations after a bad decade for the Size Factor (see fwdPE charts below).

The latter is a bit more controversial. While Ken-French-Data sort portfolios seem to make the case for smallcap value/momentum (see graphs below), especially in global markets, Jack Vogel from AlphaArchitect might disagree (ssrn.com/abstract=4078256).

Current Portfolio

I usually replace a stock if its multi-factor ranking falls below 0.80 (this one is size-agnostic btw; size punishment only applies for the buy list). Currently, candidates which might soon fall out of the portfolio are Quanex (NYSE:NX) and Jakks Pacific (NAS:JAKK) mainly due strong recent volatility which deteriorates the momentum rating in different ways (directly through a volatility ranking and indirectly though 1-month-lagged momentum deterioration). JAKK recovered strongly in the recent month which stresses the volatility rank and the short-term reversal rank on top even further. If this won’t push it off the cliff and the stock calms down again, it might stay a hold here. Next weeks’ screenings will tell.

An even more extreme recent example with similar behavior was Genie Energy (NYSE:GNE) which I bought at $9.71. After a good Jan/Feb 2023 performance, the stock crashed and wiped out all of my gains in March. This was followed by an immediate epic rally to multi-year highs. The stock now stands at $16.05 making it my best open position (+65%). Despite the extreme volatility, the value and quality scores were high enough to prevent a sell rating (multi-factor score < 0.8). I hope this example gives you some idea about the intention behind my integrated multi-factor system. Imagine the three big scores “Valuation”, “Momentum” and “Quality” as three equal, independent judges in a jury deciding about the fate of a stock.

If they decide about a new buy, all of them have to agree (multi-factor score > 0.99) and one of them having serious doubts will already disqualify a stock from being bought because there are so many alternatives.

If they decide about holding or selling a current position, the benefit of the doubt applies (multi-factor score > 0.8). One judgy score tilting “Sell” won’t be enough if the other two disagree. One score has to scream “SELL” with utter certainty or multiple scores have to have second thoughts at the same time to push a position off the cliff.

In this regard, I also like to visualize my portfolio like this to get an overview about the situation:

Please note: As for most things in factor investing, the borders are more or less fluid when it comes to thresholds for buying and selling. I use 0.80 as “magical” threshold, others might use 0.70 or 0.90. You can also use fixed holding periods with forced selling afterwards. Whatever lifts your boat. It just should be roughly at your personal sweet spot between turnover costs, tax considerations, mental preferences, decay of used factors, etc.

My current portfolio has the following median characteristics:

I use median because it gives a undistorted, rough representation without having to deal with strong outliers, harmonic means, etc. median earnings and FCF yield currently are at 16 and 18 %. Please note that median dividend yield is not that high and that median buyback yield is “only” 0. The reason is that I only screen out the worst stocks by external financing (net debt issuance + net stock issuance - dividend paid) instead of awarding high shareholder yield. In my opinion, SY has a non-linear return profile and beyond a certain threshold, higher does not mean better. Due to my momentum and quality scores, the median holding also comes with low NetDebt/Cashflow, positive margins, respectable growth and high momentum.

Nonetheless, this is no system that will find you the next Amazon. Even though I apply momentum and quality metrics, this will always be a (deep) value rotation strategy, which will always load up on cyclical, hated, unsexy names. This is no Buy-and-Hold-Portfolio. This is style or factor INVESTING by stock TRADING. Don’t get me wrong, I am no day trader. My average holding period should be somewhere be 3-12 months. Some stocks might even be held for years. However, I want to make clear that I am not married to my individual holdings. I only care about the key properties of the portfolio as a whole. Each of my stock positions is a wooden plank in the wall. Wooden planks rot over time and when they do, I replace them. That’s it. As a consequence, the average stock in the portfolio will most likely be ugly.

The following table shows current the number of holdings by industry and country:

Currently, I find a lot of interesting names in France, Japan and Poland. More recently also in Italy, even though none of them made it into the portfolio yet. In microcap terms, industries of top-ranked stocks are across the board. Naturally, there is a tilt towards industrial, cyclical consumer and basic material stocks. Especially paper, construction, automotive supplier names appear often lately. Of course the composition of the top-ranked names can vary strongly from week to week if the market regime changes.

I actually do not know if I should go into detail about my single holdings because a) I don’t do deep dives, so usually I only have a superficial overview about most things the average investor cares about (management, trends, recent news, catalysts, moats, brands, macro, revenue by geography/segment, etc.). and b) even if I give some addtional information, it would be out of context and most people would either consider buying on false premises or (which is more likely) they will dismiss the stock anyway due to its ugliness.

Here some snippets:

The Lucky Buy: I recently bought Torex Gold Resources Inc (TSX:TXG), a Canadian gold miner with projects in the Guerrero Gold Belt (Mexico). Bought just before the banking crysis and the gold rally. +20% since then

The best open position: GNE (see above) with +65%, a US (East/Midwest) retail energy utilities company which also has a solar segment.

The worst open position: Actually En+ (MOEX:ENPG), a Russian aluminum/power producer, which I can’t sell (-49%). Apart from that: Look Holdings (TSEJ:8029), a Japanese apparel manufacturer (-13%). Of course there were realized losses along the way in other prior holdings. Cutting losers early (momentum) make open positions look better than they are of course.

Personal favorites: Ingles Markets (NAS:IMKTA), my oldest holding. Even though I am only 1.3% in the green on the position (without dividends), it has a special position in my heart. I even have a older special write-up about it here on substack (see older posts).

All roads lead to Rome: Jakks Pacific (NAS:JAKK), a US toy name, and Bijou Brigitte (IBIS:BIJ), a German fashion retailer, with +10% and +23% unrealized gain deserve a special mention because my system picked them up while different investors in my inner circle came to the same conclusion (BUY) with totally different investment approaches. I like those kind of stocks, where everyone adn everything comes together.

The weirdest holding: I own a position in Compagnie du Mont-Blanc (SBF:MLCMB), a French operator of ski areas. The stock never moves. I don’t even know if it is a real stock. I don’t know if holding this is a good idea, LOL.

The ugliest holding: Even though, my Polish holdings such as Torpol and OEX are pretty ugly, the ugliest one has to be TotalEnergies EP Gabon (SBF:EC). Owning a stock of an oil&gas company operating in Gabon is as ugly as it can get.

If there really should be interest in me talking about some individual ideas in detail (with all the common disclaimers), let me know in the comments.

Cheers!