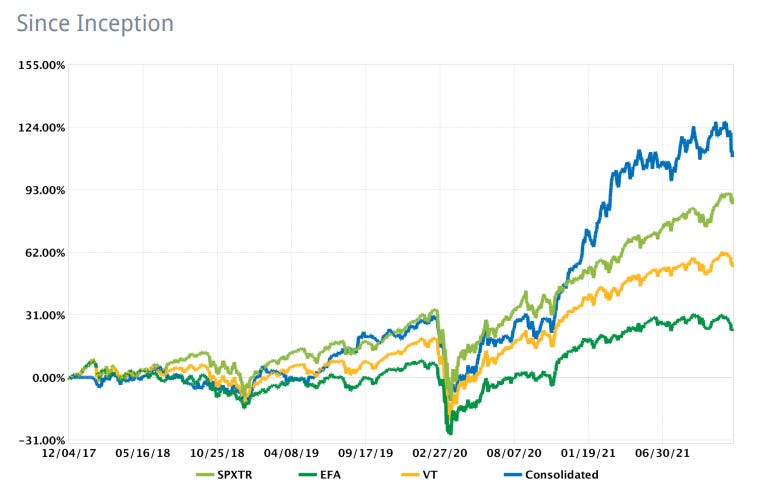

Portfolio Update Dec 01, 2021

Hello again! Since my new rebalancing process is a bit… “bumpy”… compared to my original approach, I will do some loose updates from now on instead of describing my Buys/Sells in detail. To see my portfolio composition and past trades, check out the links on the right of my Substack feed under “Further Resources” (Google Drive PDF Download).

The recent turmoil hit my portfolio, leading to a drawdown of roughly 9% max from the high but today there is some relief. So in general, nothing crazy until now. I wrote in past posts, that I “expected” turbulent times since my screen picked up weirder and weirder names in concentrated industries.

The strategy seems to be in a transition phase. It currently struggles to find clear trends, especially regarding which countries and industries to pick. However, we needed a correction at some point and if it remains a “volatile sideways” one instead of a “crash”, I’ll take it.

Unfortunately, my Dillard’s $DDS position did not quite make it into the list of replaced stocks in time. Strong short-term reversal signals, out-of-balance weight and rising multiples pushed the position lower and lower in the screen. But it wasn’t quite in sell territory yet. Now, the reversal happened, boosted by the “Omicron” sell-off. There was a larger special dividend ex day on the way but still on paper the gain melted down from +100% to +39% within a few days. This is sad, especially because I bragged about the returns online (*lol*), however, it also is part of the game. In times like this, it becomes clear why position sizing is so important.

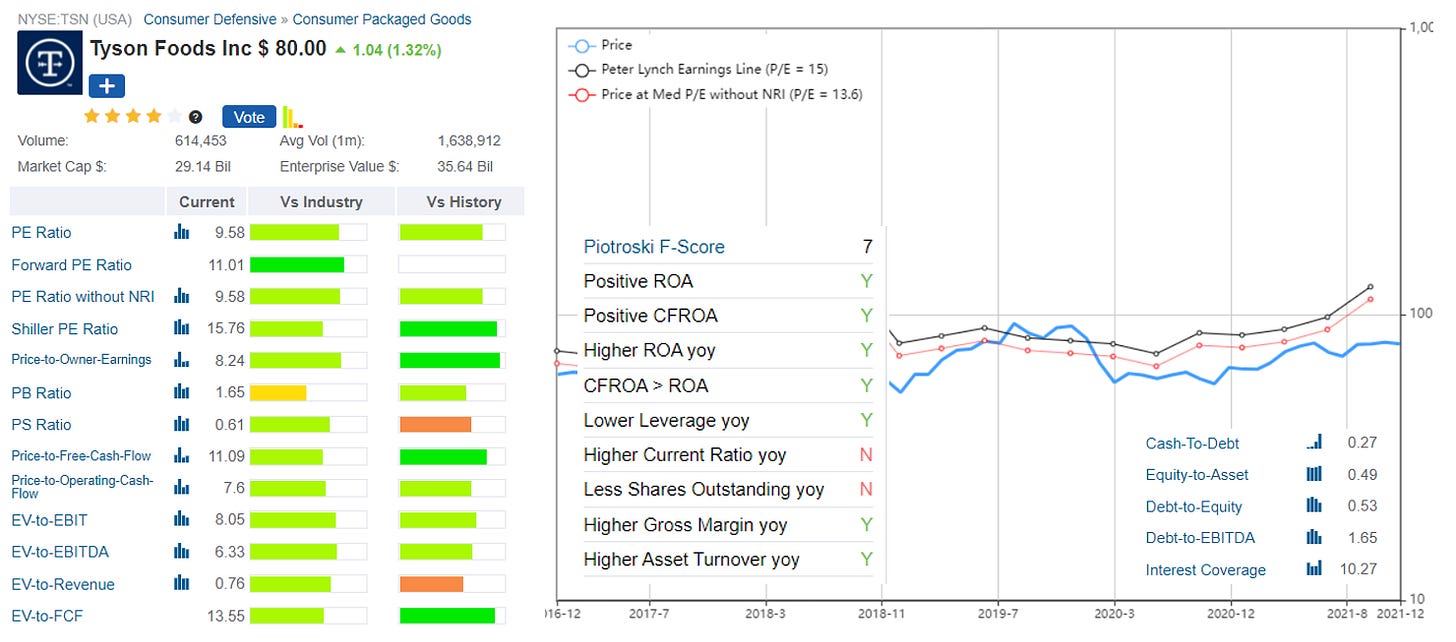

Yesterday I sold my Canadian lumber/pulp names “Interfor” (+2% TR) and “Resolute Forest Products” (-9% TR) and bought “Group 1 Automotive” (US car dealership) and “Tyson foods” (US chicken/beef products). The following figures show a quick overview about the two names (source: gurufocus.com).

I decided to reconstitute only the two highest-deviating stocks in my portfolio. If I do that I limit my turnover to max. 400% annually and my average holding period to min. 3 months. In turbulent times like this, this can lead to situations where stocks with high deviation of over 20% remain in the portfolio (to learn more about the “deviation” process, read my post “A new rebalancing approach”).

This is also boosted by some short-term “style” momentum components I recently added. It takes mainly country, industry and factor momentum (mainly of factors I don’t use in the main ranking process) of the recent month into account and is counterbalanced by short-term reversal. While its weighting is not that high, this momentum “modifier” is a short-term signal on steroids and can shift quickly. It helps me to find good entry and selling points to decide between stocks of similar Value/Quality but the increased noise in my opinion needs to be “tamed”, e.g. by using tolerance bands or by limiting turnover. Thus, I reconstitute only 2 stocks every 9 days until I have more data to look at (it was kind of unfortunate that volatility came back immediately after the recent adjustments to the process; I need to monitor it for a while before making further decisions).

The current portfolio shows this. Repsol, Corus and ArcelorMittal are currently in the “danger zone”:

Nonetheless, I am satisfied with the current approach and portfolio. My portfolio only deviates roughly 7% from my “perfect” target (MultiFactor Rank = 1 + Weight = 5% for each stock). The table also shows the implied portfolio yields. In a low yield world, a FCF yield of 18% and EBIT/EBITDA/OCF yields above 20% are nothing to complain about. Let’s just stay healthy long enough to enjoy the inevitable YEET.

Stay safe,

Non-Prophet