Portfolio Update October 2021

TOTAL PORTFOLIO:

Currently my total net worth is divided into 69% global systematic multi-factor equity investing, 13% discretionary equity positions, 10% crypto exposure and 8% cash. In the following I will give a short overview to all parts. Some crypto and cash exposure is not part of the shown stats and graphs since it is stored on other accounts.

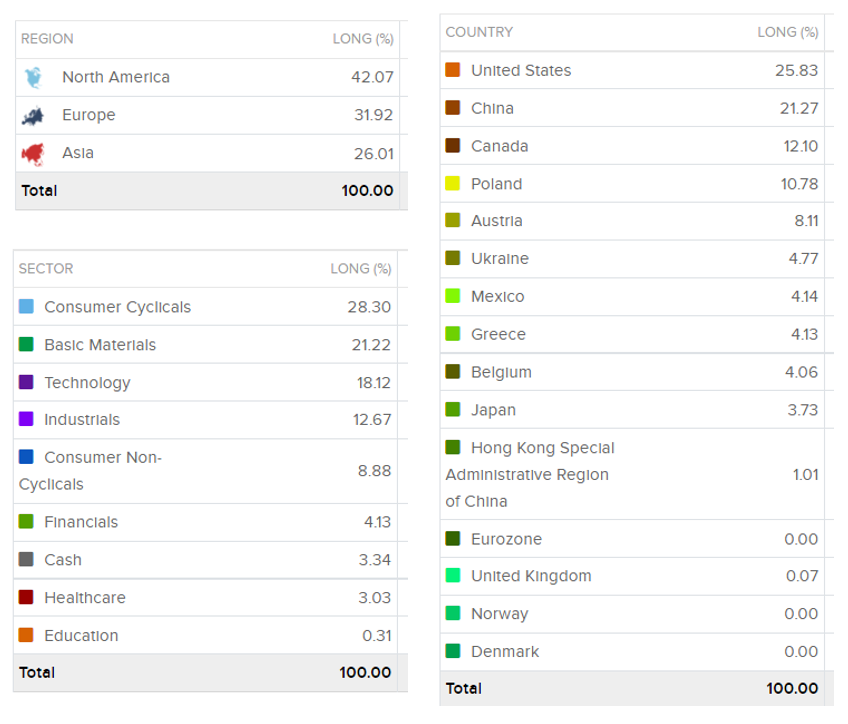

My main account (>90% equities) currently has the following exposures to industries and geographies:

Due to the high Value and Mom exposure, the portfolio historically was overweight cyclical stocks. A large share of the performance since inception came from few top performers including CitiTrends, Arconic, Gazprom and Bakkafrost. The latter two are from pre-systematic times.

The portfolio was able to outperform major benchmark indices like SPX, EFA, VT and IWM both since inception and YTD. The following graphs and tables show the underlying stats.

Time-weighted stats since inception (Dec 2017):

(AA = equal-weight portfolio of the AlphaArchitect ETFs $QVAL, $IVAL, $QMOM, $IMOM and $VMOT; Consolidated = My Portfolio)

Time-weighted YTD stats:

(AA = equal-weight portfolio of the AlphaArchitect ETFs $QVAL, $IVAL, $QMOM, $IMOM and $VMOT; Consolidated = My Portfolio)

GLOBAL SYSTEMATIC MULTIFACTOR EQUITY

Detailed information about past and present positions in my portfolio can be found in the following google sheet, which is frequently updated. Among all realized gains in closed positions, the median total return per position in the system was 21% over holding periods of 7.5 to 12 months. 56% of all trades returned more than 10%.

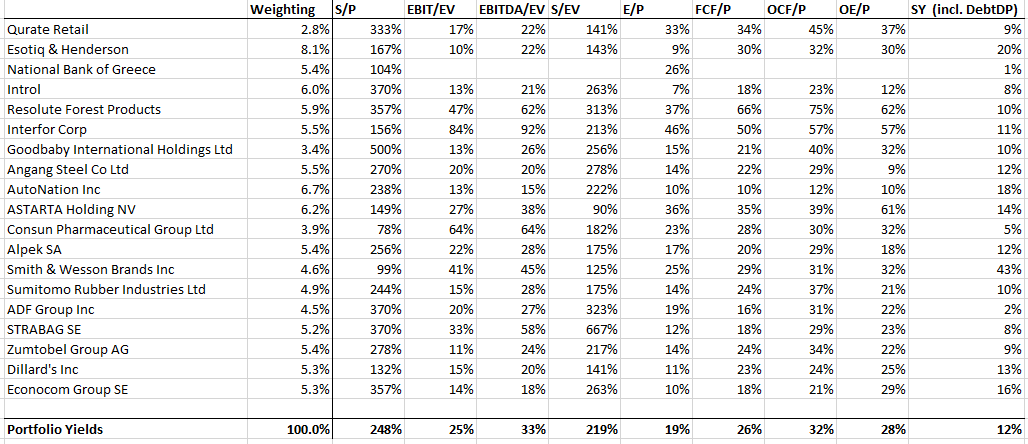

From the current portfolio holdings, the following yields arise:

The FCF yield of 26% and a shareholder yield of 12% underline the strong Value tilt in comparison to major benchmark indices. While high yield is neither a guarantee for future outperformance nor an effective downside protection in a major crash or crisis, it should increase the odds for satisfactory returns especially because I combine it with Momentum and Quality factors.

DISCRETIONARY EQUITY

In addition to my systematic investing, I started building some diversifying discretionary positions, especially in Chinese growth names. DCF models were the basis for all of these investments (data provided by gurufocus.com). The positions were built when the recent bear market in China was already at full speed. Of course, I was not able to time the bottom and nobody knows if the worst is behind us but I am sure that my cost basis is way lower than that of the average China equity investor.

Nonetheless, this is a perfect example for why Momentum matters. I bought most of the names because I saw the opportunity to get exposure to China and Megacap Tech ( historic blindspots of my portfolio) at a discount. Unfortunately, I bought one week before the announcement of the crackdown on Chinese education stocks (including New Oriental). However, I am not mad. It did not work out in the short run but especially in the recent trading sessions, China came back to life and was a good diversifier to the portfolio.

IMKTA was a position I built after a more in-depth analysis which can also be found on this substack.

CRYPTO

Historically I owned Bitcoin exposure indirectly, mainly in the form of certificates, GBTC and the European BTCE-ETN. Recently I did some restructuring due to tax reasons. Currently I own approximately 50% of my crypto exposure in Bitcoin as a mix of GBTC and spot, as well as 50% in spot Ethereum. I have no helpful technical or fundamental view on the future of crypto and I invest in it for mainly two reasons:

I see it as a right-tail hedge diversifier in my oldschool small-cap Value portfolio. I rather own crypto than high-flyer expensive stocks like Tesla. Reason: The latter are still stocks and will be judged as such at some point in the future. Crypto is a non-cashflow tech asset class and acts like a commodity or precious metal in my opinion.

I like crypto for its psychological/tribal/cult aspects. I have no idea if it is the future but many people seem to believe in the concept. Despite a market cap of almost $2.5T, we are still early in the adoption process and with each day crypto survives, the followership and the cult around it become stronger and stronger.

I find it dangerous to be invested in crypto to 100%, even though I don’t think it will go away at this point. That said, even if my 10-15% crypto exposure goes to zero, I won’t die either. I see the opportunity as a diversifier but I have to admit that the chance/risk ratio at current valuations is questionable. Will Bitcoin go to 100k, 200k or 500k? Will there be another 80% crash soon? Which coins or tokens will be the winners? Which coins or tokens will disappear? I could see Crypto approach the ~$13T precious metal market cap within the next 5-10 years, which would be a 5x from here. But what do I know…

Yours sincerely,

Non-Prophet