Q4/2024 data now available on the Ken French Data Explorer

The Ken French Factor Database was finally updated and the 2024 data is complete. I now added the new data to the Ken French Data Explorer.

In the following, I will show some charts and tables to summarize the year.

Macro

Big year for US total market and Gold

Developed Markets lagged but were boosted by the high US weighting

Commodities outperformed US bills and bonds

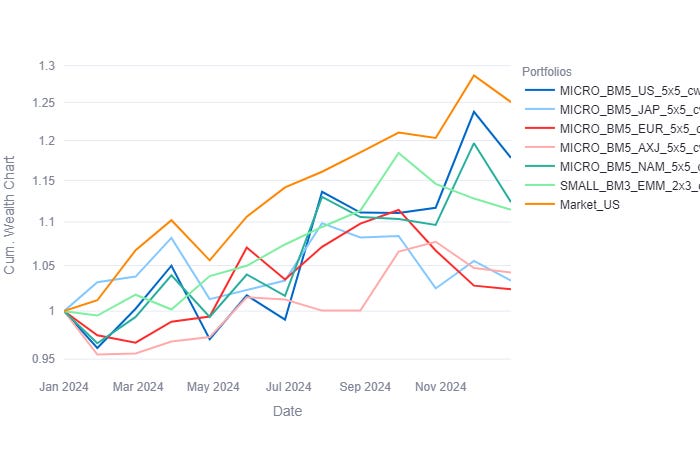

Microcap Value

No broad Microcap Value (Book-To-Market) Portfolio was able to outperform the US market.

However, US and EM (incl. China) Microcap Value were able to keep up

Developed exUS Microcap Value lagged significantly.

Other measures of US Smallcap Value (Earnings Yield EP, Cashflow Yield CFP, Dividend Yield DP) fared similarly but underperformed in December:

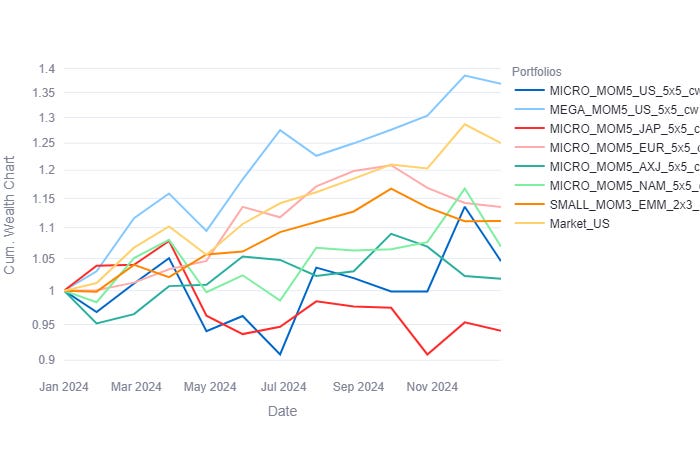

Microcap Momentum

2024 was a big year for momentum ETFs, however, that mainly worked in megacaps (MEGA_MOM5) due to a handful of names

No broad global Microcap Momentum Portfolio was able to outperform the US market

Asian and US Microcap Momentum Portfolios significantly lagged (underperforming T-Bills and having a negative Sharpe Ratio)

A integrated combination of US Small, Value and Momentum, also had trouble in 2024 (see my portfolio 2024 recap or e.g. $XSVM)

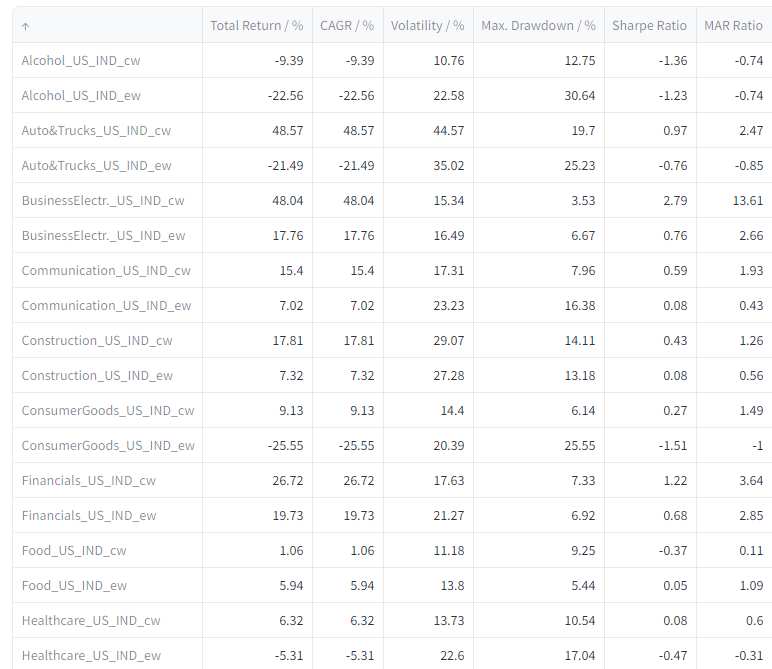

Equal-Weighted vs. Cap-Weighted

A big theme of 2024 was size. As indicated in the previous section, “Smaller” equaled “Worse” in most parts of the market.