Quick Thoughts on Ranking System Weighting Schemes, Strategy Considerations and the Universe

Ranking System

I personally try to not hassle too much with weights in the ranking system. I group similar single metric ranks equally-weighted into composites and continue hierarchically to top-level (value, mom, quality, etc.). I start out with also equal-weighting these top-level composites to get a "reference".

Of course to get there, I do a lot of research on single metric basis:

Does the metric add value historically (academic research and practitioner evidence),

is there reason to believe that this anomaly is still intact and has a logical reason to remain intact

does it somewhat (not perfectly) separate good from bad stock picks in my universe (individual backtest)

From the 1/N reference ranking system, imo shifting away from equal-weight should have some logical anchor so you can systematically re-evaluate at any pointin the future. Why? Because optimizing opens the door to overfitting if you get to cocky. I am not saying that equal-weighting is the holy grail of trading and investing but imo it is a robust, self-correcting reference point and deviating from it needs expertise and care.

If you really want to optimize for performance, do so across enough years spanning at least one full cycle including a bear market. Also consider re-evaluation ("retraining") once a year like you would do in ML with Time-series or rolling CV.

Other reasons to deviate from Equal-weight include:

Turnover-weighting to manage trading costs

Personal Conviction (overweighting core beliefs e.g. if you are a Value Investor at heart, you can overweight Value and use other factors as satellite kickers)

Currently, with Portfolio123 on the top-level, I combine ML model predictors equally-weighted with my classic ranking system, which is in itself an equally-weighted combination of composites consisting of equally-weighted subranks of Value, technical Momentum, Fundamental Momentum and Size…

“Equal Weight Inception”

The idea behind it:

The classic EW ranking system is the linear Ebenezer Scrooge who assumes that markets never change and acts as anchor. The ML predictors add a decision tree based layer, reweight feature importances and find nonlinearities (and noise) in combination, we should get a somewhat robust, somewhat self-correcting, somewhat diversified “panel of independent judges”.

Strategy considerations

When you go the next step to actual simulations and strategy backtests, imo Rebalance (actually Reconstitution) frequency for a well-balanced multi-factor ranking should almost always be as frequent as possible (e.g. weekly). You always want the freshest information and also max. sample size in a simulation.

Then manage Rank tolerance to meet best balance between personal turnover preferences and after-slippage performance (having realistic slippage assumptions is key).

There certainly are systems which profit from monthly, quarterly etc. rebalancing instead but imo a good multifactor ranking system should scale linearly with concentration, frequency, and rank tolerance. A severe performance hick-up in any of those (e.g. when going from 20 to 10 stocks, from monthly to weekly, or from Sell Rank < 90 to < 95 often is a warning sign!)

Concentration-wise, portfolio math gets shaky below 10 positions and sample size in the simulation is maybe not reliable anymore. I am not a big fan of position sizes > 5% of the total account. Even if the backtests look nice, I can not justify the increased risk for out-of-sample performance. To be clear, in a good system, 3-5 stock expected return should be fine, even fabulous. The problem is not the expected return but the exponentially increasing outcome variance. I just don’t want to gamble that I am in one of the good timelines instead of one of the disastrous ones.

If you have a well-balanced ranking system, one of the main goals on the strategy level (and I ignored that part in my pre-Portfolio123 past) is finding the sweet spot between:

Reconstitution Frequency (as high as possible)

Concentration (as high as possible)

Rank tolerance (as tight as possible)

and

Turnover as low as necessary (trading costs and slippage)

Diversification as high as necessary (blow-up risk)

Scalability/Capacity as high as necessary (account size)

Universe

Finally, it is really helpful to distinguish the different levers to pull in order to outperform. Creating a way to rank stocks or training a ML model is just one of them. Actual leverage can be a powerful but two-edged sword. Option overlays, long/short etc. add further complexity to the story.

Most importantly, the best ranking system is worthless if you are fishing in the wrong pond. Usually, academia just looks at liquid cap-weighted universes. But there are many ways to slice and dice the stock universe. Mainly by sectors, size buckets and regions.

Often these themes are dealt with by considering factors like Beta or Size but imo that’s not the same thing as clearly defining the borders of your stock universe e.g. by only looking at stocks below a certain liquidity level.

The same ranking system (even if it includes a size factor) will perform differently in the S&P500 and exS&P500, in cyclical sectors vs. defensive sectors, in US vs. ExUS.

The obvious conclusion from watching all the competition on Wallstreet would be to avoid it. And how do you best avoid it? By going where they can’t go: Too illiquid, too different, not scalable.

You don’t have 5 Billion in AUM, you don’t have career risk, you don’t have to kiss the ass of your boos and your client. As your own asset manager, you only have to convince yourself and meet your own (comically tiny) liquidity needs.

I will show you a simple system based on two factors. Equal-weight Ranking based on EBITDA-Yield and Sharpe Ratio.

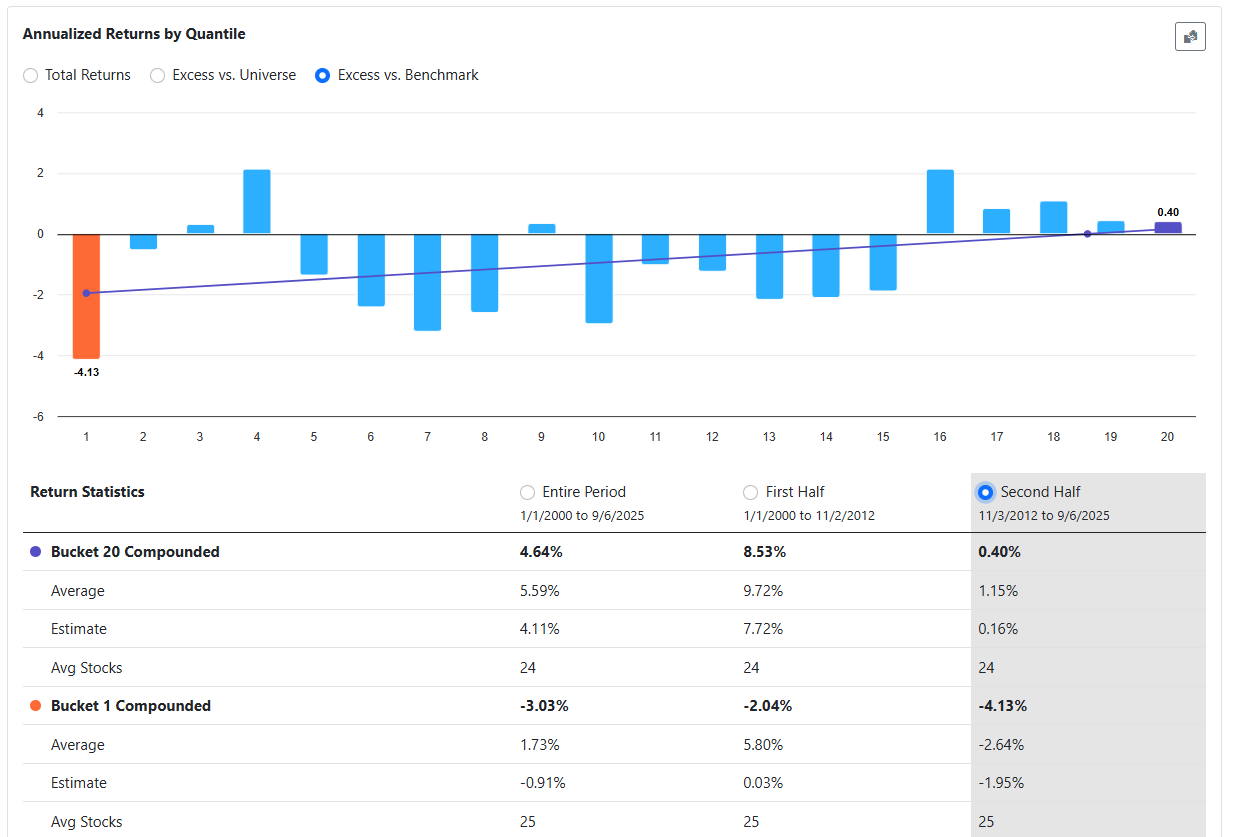

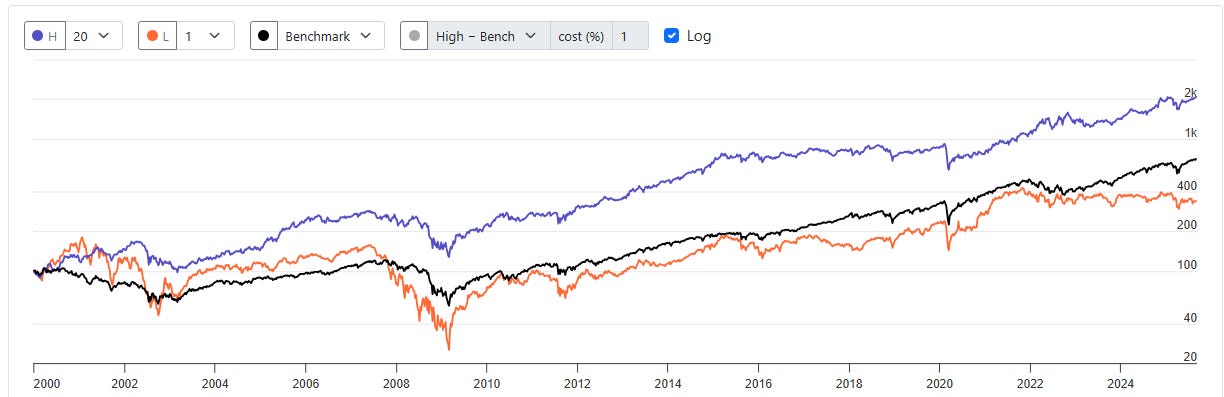

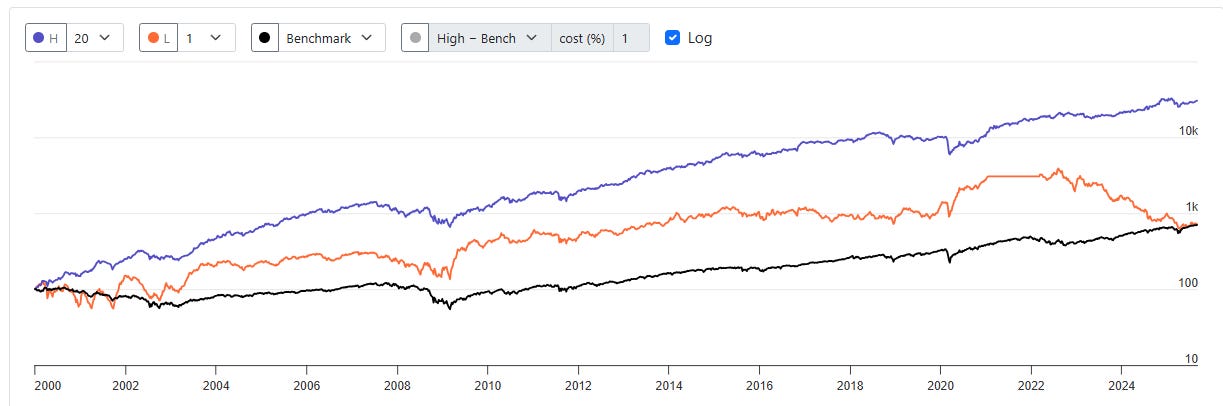

In the S&P500:

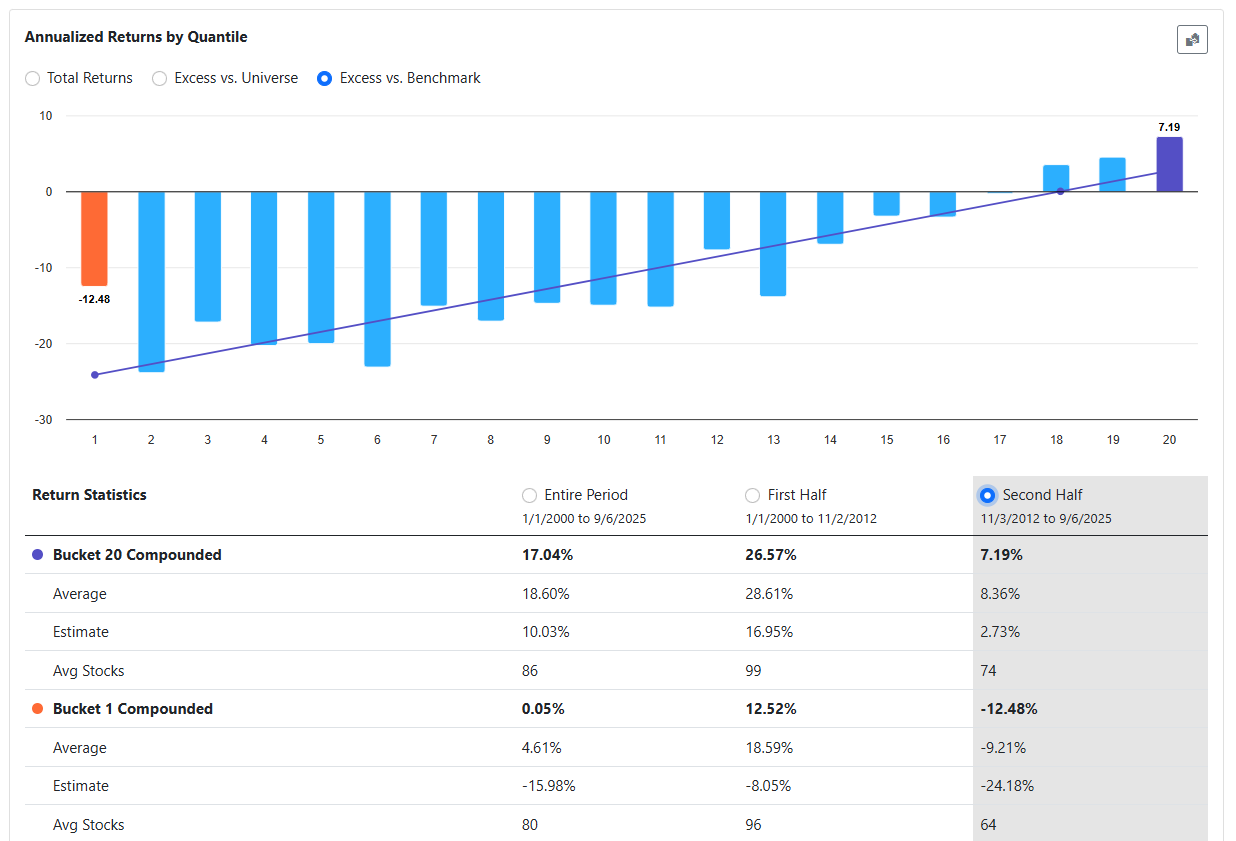

In US-listed US companies with Market Cap < $500M (median dollar volume last 100 days > 50000, Price > $0.1, as of today: 1777 stocks):

Same process, different pond. Similar evidence can be seen for discretionary microcap investors e.g. active on X or MicrocapClub. And the best part: The best microcap investors usually graduate at some point into smallcaps due to scalability issues, especially if they start a hedgefund or similar to manage outside capital. And even if they stay in microcaps, usually they become whales which need days and weeks to enter or exit a position due to the limited liquidity.

You are a small fish. Act like one. look for food in the coral reef, not in the open shark-infested ocean.

Really good post, some stuff to think about.

Don't you think that very frequent rebalancing (e.g. weekly) just increases turnover and transaction cost? Fundamental data only changes quarterly or even slower. So the only thing that changes is the price.