Build-A-Bear Workshop

Build-A-Bear Workshop, Inc (headquartered in St. Louis, Missouri) is a multi-channel retailer of plush animals. The company was founded in 1997 and operates in the USA, UK, Canada, and internationally in the segments Direct-to-Consumer, Commercial, and International Franchising.

Products range from plush products (to be stuffed or pre-stuffed) as well as sounds, scents and accessories that can be added to the stuffed animals. Furthermore, the company sells clothing, shoes, accessories, toys, amongst others. The company sells its products own stores under the Build-A-Bear Workshop brand name ; and sells its products through its e-commerce sites and third-party marketplace sites.

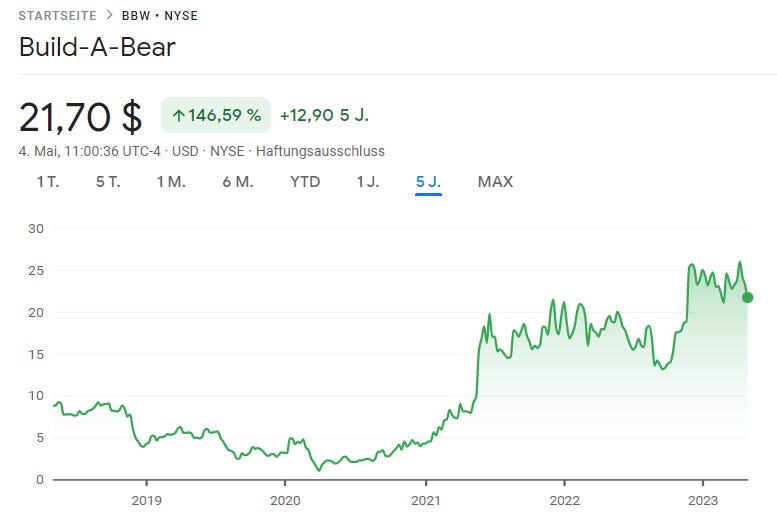

The stock had a good run since 2020 and is currently in consolidation mode. Either a good time to buy or the end of the three-year uptrend? You decide. Do your own due diligence.

Regarding the quantitative rankings, BBW is not the cheapest stock on a naive global comparison but still ranks in the top 10% of the roughly 24000 stocks in my screen. Not bad. Earnings Yield is about 15%, FCF yield is about 8%. Recent buybacks were nice but might be temporary. Sales growth over the past years was mediocre at best. Profitability is currently high, debt was paid down over the years and is at reasonable levels. This is also reflected in the high quality rank. However, the company might be overearning. That’s why I’d keep a look at the momentum. If the trend breaks, don’t chase this stock!

To conclude: Even though it ranks high, I still find cheaper opportunities in Europe and Japan. If this stock might be interesting to you, do your own due diligence and research qualitative criteria on top! From a purely quantitative POV, BBW might be a nice Value+Momentum play for the intermediate term but the position most likely needs monitoring and is no multi-year Buy&Hold.

Disclaimer

I am currently not invested in the stock. This is no financial advice or endorsement to buy or sell this security. No warranty for correctness of data.

Hard to imagine the market is big enough for significant growth.