Rebalancing July 12, 2021: Selling Esprinet SpA and Buying ASTARTA Holding NV

SELL: ESPRINET

Esprinet SpA ($870M market cap) operates in the wholesale distribution of IT and consumer electronics in Italy and Spain. It is enganged in the B2B and B2C distribution of IT, consumer electronics and microelectronic components. I sold the stock for a 145% pre-tax gain (bought on September 21, 2020).

The business most likely profited from the increased demand for IT and electronics products due to COVID-related work from home. Revenue grew by almost 14% in 2020 and the stock price and net profits moved accordingly, as visible in the following Peter-Lynch Chart:

Data source: gurufocus.com

Even though the stock price is a bit elevated in realtion to trailing earnings (P/E = 20), the overall Valation rank of Esprinet is still pretty decent. Obviously, the momentum rank is very favorable as well. The stock still ranks in the top decile of my Multi-Factor Ranking.

The main problems arise on the accounting side (recent debt issuance, overall high external financing and asset growth). I want maximum exposure to my system so being in the Top decile of the overall system is not enough for me. I want only the best, so for me it is a sell. For anyone else: I guess it still a good “Hold” from here but the stock lives off the Momentum which can tilt at any point in the future.

BUY: ASTARTA HOLDING

The new stock I bought on the Warsaw Stock Exchange is a small-cap ($300M) agricultural stock from Ukraine. ASTARTA Holding NV is engaged in the

cultivation of sugar beet, grains and oilseeds,

production of sugar products and soybean processing,

crop growing,

cattle/dairy farming.

As usual, to get an overview about the exposure to the single factor ranks in my system, the following table shows a comparison of Esprinet and ASTARTA:

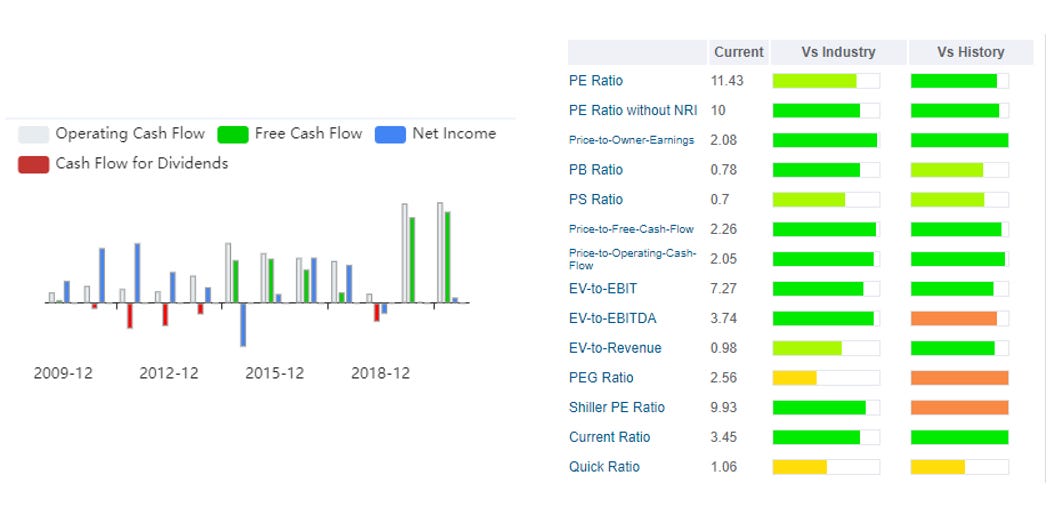

The stock is pretty cheap across the board also due to high free cashflow in 2019 and 2020. Despite recent momentum, Eastern European small-caps are not the hottest topic on Wallstreet right now, especially if the business depends on commodity prices.

Data source: gurufocus.com

The stock price naturally correlates with major soft commodity prices, especially the sugar price. The recent momentum of the stock also originates from this relationship. It is a bet on continuing inflation in the agricultural sector, also with regard to the biofuel market.

Data source: gurufocus.com, tradingeconomics.com

Regarding the quality of the business, the high F-score and decent debt downpayment over recent years are notable positives. Debt and profitability are non-critical and in a typical range regarding the peer group:

Data source: gurufocus.com

While parts of the reflation trade started stumbling recently (e.g. lumber futures), my system still finds many commodity-based opportunities in deep corners of the international equity market. Only the future will tell if this is the right call. This is my first agricultural stock, so I am quite happy with the addition to my portfolio as a diversifier.

Kind regards,

Your Non-Prophet