Rebalancing July 22/23, 2021: Selling Dampskibsselskabet NORDEN A/S and Buying Consun Pharmaceutical Group Ltd

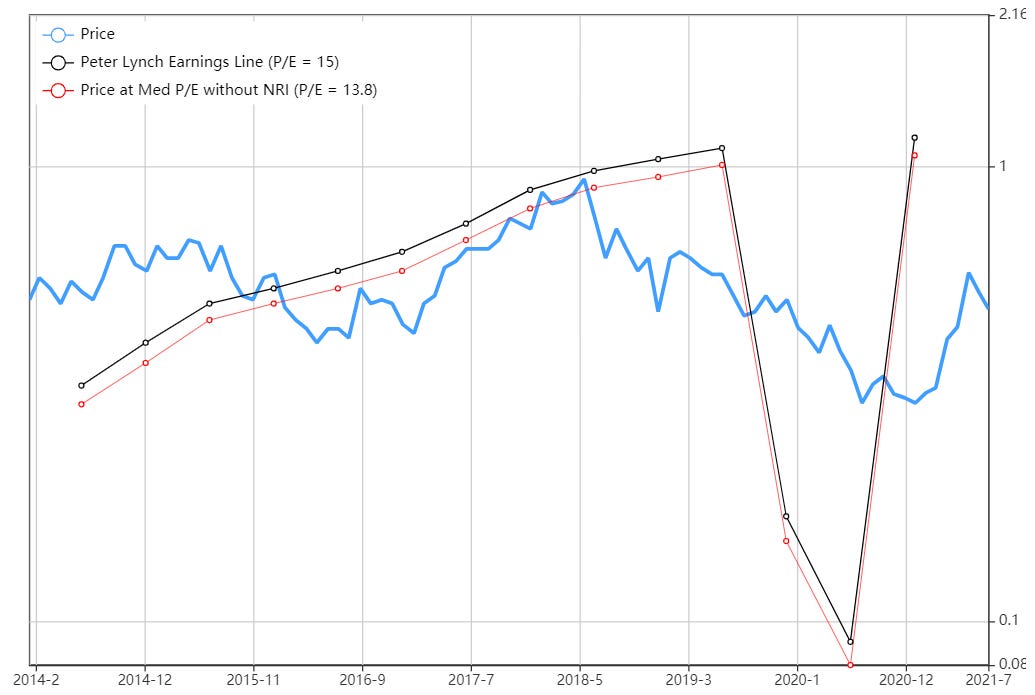

SELL: DAMPSKIBSSELSKABET NORDEN A/S

Last week I sold my shares in the independent danish shipping company D/S NORDEN (market cap $1B) for 83% pre-tax total return. The company operates mainly in the transport of bulk commodities such as grain, coal, iron ore, and sugar. The stock mainly profited from the recent rise of commodity prices, demand and inflation in the framework of the post-COVID reopening trade.

The stock still shows strong momentum, however due to the deteriorating fundamentals, the multi-factor ranking fell to 0.80. Multiples like P/E and EV/EBIT reached >20, debt is high and growing and F-score is at a mediocre 5. Thus, the stock is a Sell for me after a holding period of approximately 9 months.

Source: gurufocus.com

BUY: CONSUN PHARMACEUTICAL GROUP LTD

This is the third Chinese stock in my portfolio and that amidst the recent turmoil in the Chinese stock market. Consun Pharma ($550M market cap) generates most of its revenue from selling modern Chinese medicines and medical contrast medium. In the “Yulin” pharmaceutical segment, it furthermore manufactures and sells traditional Chinese medicines. Consun’s product portfolio include contrast medium, kidney medicines, orthopedics medicines, dermatologic medicines and hepatobiliary medicines. The following table shows the main ranks in my latest screen for Consun Pharma in comparison to the replaced D/S Norden:

The stock is cheap in comparison to peers and its own history. Within in the ranking system, Sales-multiples are the only weakness. A P/S ratio of 2.2 and an EV/S ratio of 1.4 are nonetheless rather low in the current environment, especially for a pharmaceutical company. The Free Cashflow yield is above 20% on the present basis.

Source: gurufocus.com

Of course, there are always concerns about Chinese accounting practices, potential fraud, and regulatory risks. By considering Momentum und Quality metrics, those risk can be reduced (but never to zero). The business and the stock had a bad 2019 and a bad 2020, which puts them into the “Long-term Reversal” bucket. Since the beginning of 2021, the stock showed strong momentum in consequence of the latest earnings recovery.

Source: gurufocus.com

The biggest positives on the quality side are the low asset growth over recent years, the high stock buybacks (1Y Share Buyback Ratio 5.3%) and the high Piotrosky F-score (9 of 9). Furthermore, the company has a high interest coverage, low leverage, high margins and a consistently high ROIC. The only issue found is recent minor net debt issuance, which is, however, not in “Red Flag” territory.

Source: gurufocus.com

Despite the recent turmoil in China, the stock is good diversifier to my portfolio, since it gives me exposure to Asia and the healthcare sector, both of which are underrepresented in my prior holdings. I have no particular view on macro or geopolitics. If my system bets too heavily on a certain region or sector, I simply limit the maximum exposure to avoid concentration risk but that point is not reached yet for China in my case. Nobody knows how the latest regulatory risks will play out over the following months or even years. The CCP is unpredictable at this point but I am certainly not qualified to judge the situation. I just know that there is enormous fear in the market, and whenever there is fear, there is opportunity.

I am quite sure the momentum scores of Chinese names in my screener will collapse by end of August at the latest. Until then I will not abstain from buying Chinese names, as long as the numbers are aligned.