Rebalancing June 24/25, 2021: Selling Bastei Luebbe AG and Buying Angang Steel Co Ltd

SELL: BASTEI LÜBBE AG

Last week, the last German stock left my portfolio. I sold Bastei Luebbe AG (Market Cap $92.6M), a small media company and publishing house. The company publishes books, audiobooks, eBooks, and other digital products and derives a majority of revenue from Germany. I bought the stock on August 17, 2020 and now sold it for about 89% pre-tax gain.

Actually Bastei Lübbe still ranks on a pretty good #154 of over 6000 stocks in my screen. The Accounting and Momentum Composites both are in a 0.99 of 1.00 sweetspot. Furthermore, no red flags were detected. The main issue is the valuation duue to the recent multiple expansion. The Value punishment mainly originated from bad recent EPS growth, bad projected FCF and deterioration of P/S related the stock history:

BUY: ANGANG STEEL CO LTD

Instead I bought my second (ugly) Chinese stock. Angang Steel Co Ltd (Market Cap $6.3B) operates in the steel rolling and processing industry. The Company's products include hot-rolled sheets, medium and thick plates, cold rolled sheets, color coating plates, heavy rails, seamless steel pipes and wire rods. Customers industries are machinery, metallurgy, petroleum, chemical industry, coal, electric power, railway, shipbuilding, automobile, construction, home electrical appliances and aviation. Geographically, the group derives a majority of revenue from the China region.

To get an overview, the following table shows a comparison of ranks in my screen for Bastei Lübbe and Angang Steel in comparison:

The valuation of Angang Steel as an “ugly” Chinese heavy-industry company is naturally low. To be honest, I would not trust a pure Value approach on this stock, and yes, buying it also makes me uncomfortable. The main multiples are shown in the following:

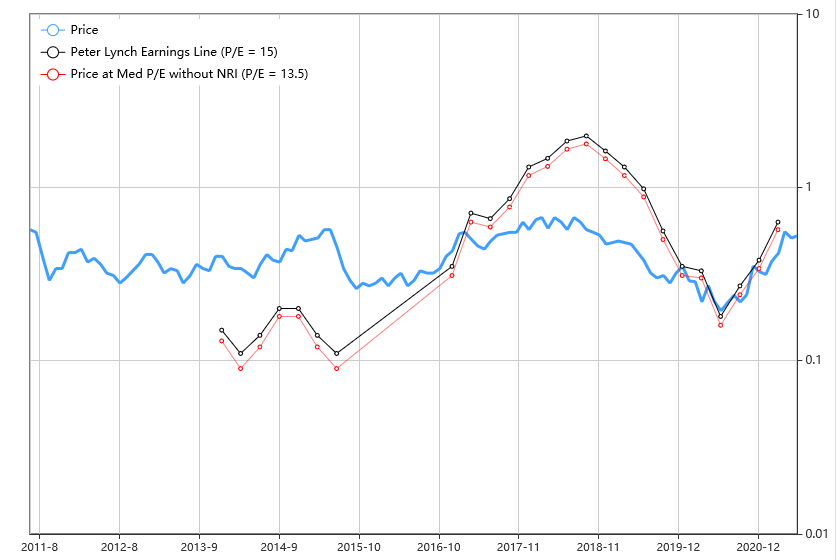

The key drivers of the buy decision, however, are Momentum in Stock Performance and Fundamentals. The following Peter-Lynch Chart shows the stock price of the last 10 years in comparison to implied stock prices at fixed P/E multiples (all values in €). The stock exhibits a good combination of long-term reversal (bad 5-10 years performance) and recent price momentum. Technicians could argue that the stock hit a long-term resistance and might revert (but I am no technical trader, I am a multi-factor investor):

Regarding the fundamental momentum and asset growth, the metrics show favorable behavior as well. Piotrosky F scores a high 8/9, debt is payed down, accruals and external financing are low and revenue is stable. Debt/EBITDA is high but not critical (no red flag territory):

It is a risky bet and noone should buy this stock with a larger portion of his/her portfolio. It is a bet on Chinese and global recovery and continuing inflation and demand for basic materials. The stock is a nice diversifier to my portfolio. However, high-quality value opportunities became rare recently. We will see how the Chinese stocks will hold up in the following months.

Kind regards,

Non-Prophet