Rebalancing October 5, 2021: Selling Triple-S Management Corp; Buying Econocom Group

SELL TRIPLE-S MANAGEMENT

Today I replaced my Triple-S Management (Puerto Rico, MCap $836M, Healthcare Plans) position. To be honest, I sold the position already in September because the stock traded flat since an acquisition announcement by GuideWell in August. The announcement resulted in a strong bounce of the stock price, resulting in 38% pretax TR for the trade since the buy on March 4, 2021.

Source: gurufocus.com

BUY ECONOCOM GROUP

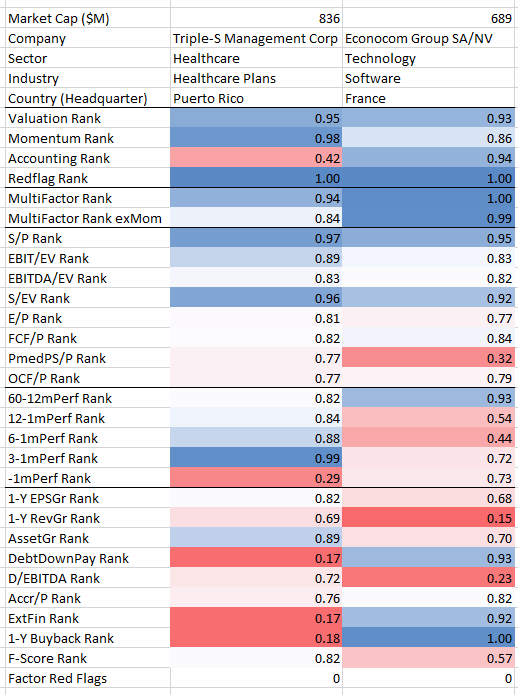

Triple-S still ranks good on most ranks. However, it has to be replaced anyway due to the acquisition. A comparison to its replacement “Econocom Group” seems unnecessary but I do it anyway. The following table shows the major rankings for both stocks.

Econocom Group is a French company dealing with the digital transformation of businesses. The company operates in the consulting, management, financing, applications and services for IT systems of clients. Furthermore, Econocom provides IT security tools and services, web and mobile applications, and project financing. The company generates revenue from Europe and America, with operations in France representing more than 50% of total sales.

The digitization narrative is compelling since many European companies (and whole countries) are left far behind by the (overseas) competition in this regard. However, Econocom is not a “perfect” factor investment. There are some deficits in the 12-1m and 6-1m Momentum ranks, the TTM revenue growth is almost in red flag territory and the F-score is mediocre due to shrinking margins. It is mainly a Long-term-Reversal/Value/Shareholder-Yield bet. There were a few “better” stocks in my latest list but I either had no access (illiquid microcaps from Scandinavia or Eastern Europe) or Iown them already (Angang Steel, Dillard’s, Zumtobel, Strabag, Astarta, Alpek).

Source: gurufocus.com

Recent declines in earnings and revenue and the rather high debt load inevitably make the Econocom unsexy for most growth/quality investors. However, the industry is a nice addition to my current portfolio from a diversification POV. Markets still try to find their direction between China turmoil, inflation fears and fading post-covid growth. It is difficult to tell what will happen next.

In my opinion, preparation beats prediction. And the best preparation for a stock-only investor is to diversify across different sectors and countries around the world.

Kind regards,

Non-Prophet