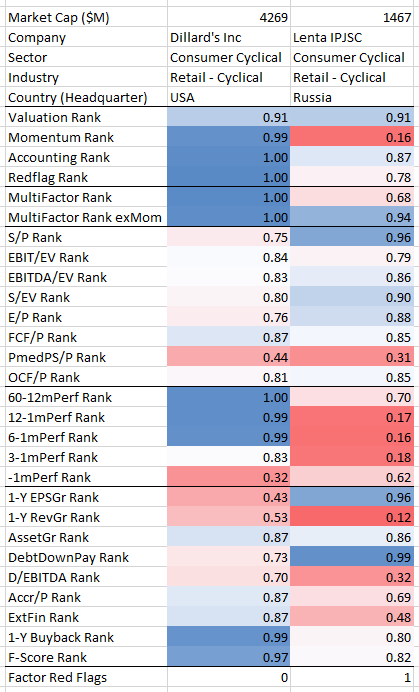

Rebalancing September 27: Selling Lenta IPJSC; Buying Dillard's Inc

This week I realized my first loss since February 2021 ending a long winning streak. I sold “Lenta IPJSC” (Russia, supermarkets stock, MCap $1.5B, bought on February 16, 2021) for a pretax TR of -14%. In comparison, the “iShares MSCI Russia ETF” returned over 20% in the same time frame.

Source:

https://docs.google.com/spreadsheets/d/e/2PACX-1vSn_7YGRDRtFSBTT-mThrwOhMGAQdddITQm1l-u1GoJYTZhVmpQq64MvrbELf8mQtzGkPFp7nIbWHkX/pub?output=pdf

The stock itself actually seems totally fine from a fundamental point of view. The Value composite rank is still at strong 0.91 (of max 1) and the Accounting composite rank is at a strong 0.87. Combined that results in a “Multi-Factor (exMom)” rank of 0.94! However, the market has a different opinion and the stock is in a consistent downtrend since March.

Source: gurufocus.com

The reason for the decline? I am not sure. According to the official website of Lenta, there were several acquisitions and some management changes this year. Furthermore, revenue declined by about 9%. Maybe there is something in there. However, the stock is not really covered in financial media and I am too lazy to dig deeper. For everyone willing to to the work: Similar to Ingles Markets (IMKTA), Lenta might be a supermarkets stock worth a long-term position. At least it seems to be one of the better emerging market stocks.

That said, due to the very low Momentum Rank:

I replaced the position with “Dillard’s Inc” (USA, apparel retail stock, MCap $4.3B). The company sells fashion apparel, cosmetics and home furnishings to generate most of its revenue. Dillard’s also operates a general contracting construction company, CDI Contractors, which constructs and remodels Dillard’s stores. Sold brands include Antonio Melani, Gianni Bini, Daniel Cremieux and Roundtree & Yorke. To get an overview about the trade, the following table shows the main ranks in my system for Lenta and Dillard’s in comparison.

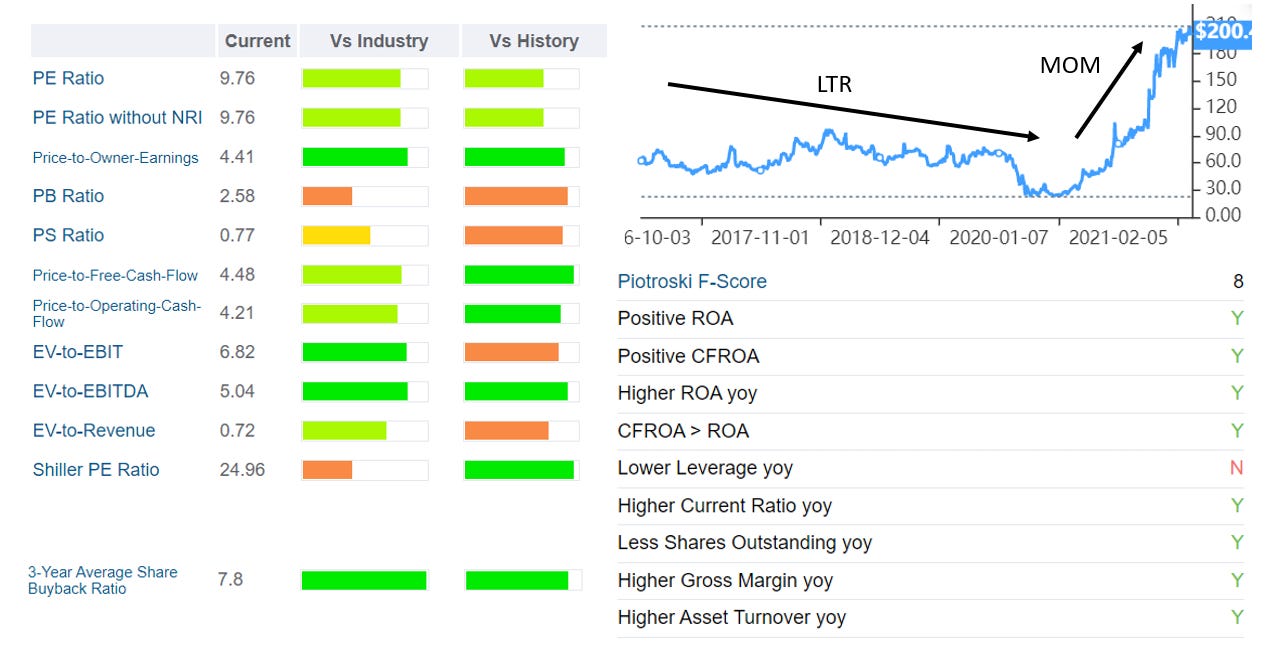

Dillard’s is mainly a (fundamental and technical) momentum play with perfect Momentum and Accounting Ranks. However, the Value Composite score is in the top decile as well. Like many other cyclical retailers right now, the stock shows a typical chart with stale performance between 2016 and 2020 (Long-term Reversal) and skyrocketing returns in 2020/2021 (Momentum). The stock is very cheap on a trailing multiple basis and has a high F-score. Furthermore, it persuades investors with high share buyback ratios.

Source: gurufocus.com

Dillard’s is not the most diversifying pick for me right now since I already own other similar retailers like “Qurate” or “Esotiq & Henderson”. However, these positions will be rebalanced soon, so the time of “concentration” should be limited to a few weeks. My portfolio did quite fine during the recent turmoil. Despite my rather big China exposure, I currently am in a <5% drawdown from the ATH on September 6.

Let’s see how the inflation fears, supply chain issues, tech crackdowns, Covid waves, geopolitical tensions, German elections, societal turmoils and other doomsday news will affect the markets. As always, I don’t know what will happen and I will play the cards I am dealt with.

Yours sincerely,

Non-Prophet