Rebalancing September 7/17: Selling Imperial Brands and Heijmans; Buying Strabag and Zumtobel

My apologies. I am a bit behind schedule on my writing. However, the reason for the delay is a pleasant one: I finally finished writing my PhD thesis. There is some organizational paperwork left to do before submitting it but still! It feels freeing to have this monster project behind me. I made the classic mistake to underestimate the work needed for corrections, double-checking, refining the Figures and Tables and doing the typesetting. To all past, current and future PhD students out there: I feel with you.

Of course, my investing did not stand still during that time. Since the last post, there were three position rebalancings in my portfolio. In the present post I want to briefly summarize the first two trades. I’ll talk about the latest trade separately to finally get my writing schedule back on track.

SELL IMPERIAL BRANDS AND HEIJMANS

On September 7, I sold “Imperial Brands PLC” (UK Tobacco stock, MCap $20B, bought on January 11, 2021) for a 4% pretax TR. This was my first tobacco play ever. I personally don’t smoke and never understood smoking but here I am. Tobacco stocks recently were torn in the nether realm of narratives between “cheap dividend stocks”, “dead industries in secular decline”, “ESG”, “the future of cannabis” and others. Among peers, Imperial Brands is rather oldschool in my opinion.

The stock is still dirt-cheap. I bought into what seems like a long-term bottoming process starting with strong momentum in late 2020. Unfortunately, since then the stock traded volatile sideways. I am quite confident that the stock will show up on my list again at some point but for now the momentum is broken and the stock needs to find its direction.

Source: gurufocus.com

On September 17, I sold “Heijmans NV” (Dutch construction stock, MCap $309M, bought on January 28, 2021) for a 22% pretax TR. The stock clearly profited from the global post-COVID construction boom. Similar to Imperial Brands, the stock was (and still is) dirt-cheap and showed strong momentum in 2020. I was able to squeeze the last drops out of the trend (+ dividend). The price topped in an historical barrier and since then Momentum collapsed. Additionally, my accounting composite rank is not impressed. So for me, Heijmans was a sell here.

Source: gurufocus.com

BUY STRABAG AND ZUMTOBEL

As replacements, I bought two Austrian company stocks: “STRABAG SE” (construction, MCap $4.8B, bought on September 7, 2021) and “Zumtobel Group AG” (lighting, MCap $453M, bought on September 17, 2021). To give a first overview, the following table shows the main ranks of the replaced stocks and their replacements in comparison.

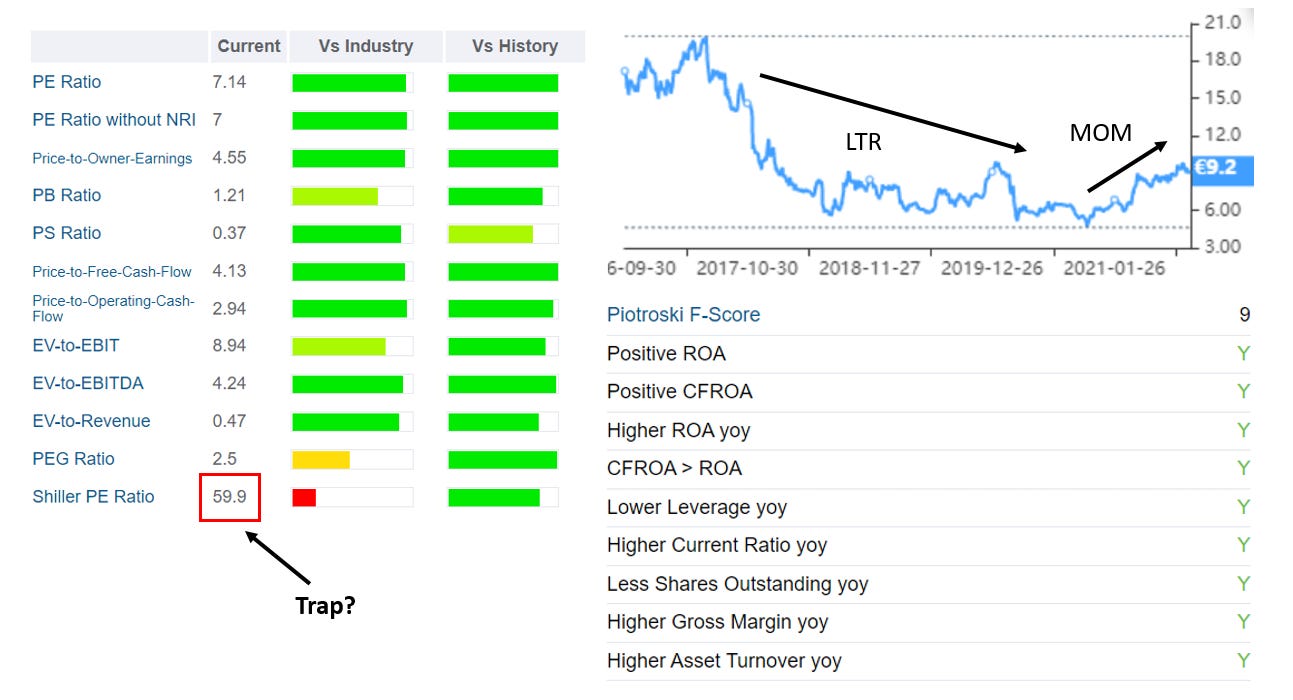

STRABAG SE provides broad construction services from planning to execution and demolition. The company builds large transportation infrastructure, plants, commercial and industrial facilities. Some projects are granted through concessions from regional governments. Majority of the revenue comes from Germany and Austria. The stock brings all quantitative qualities I am looking for to the the table: High 60_12month long-term reversal signal, strong recent momentum, low external financing, high F-score, high Value multiple composite and all that without major red flags.

Source: gurufocus.com

Regarding the latter I have to admit that the terms “Strabag” and “no major red flags” usually don’t go well together in one sentence. A friend on Twitter pointed out that the company was involved in many scandals in the past. Nonetheless, I am a quantitative investor and qualitative red flags are not part of my process. Actually, I am quite sure that at some point I will buy into an obvious fraud. However, I believe that historic factor performance already accounts for the “bad apples” and it is impossible to tell which scandal will result in a financial disaster and which one gets resolved and will result in a multi-bagger. In my opinion, the usage of asset growth, external financing, momentum and F-score already gives sufficient protection against most traps. The rest is fate.

The second pick, Zumtobel Group AG, is in the business of lighting solutions. According to gurufocus.com: “The company also manufactures and hardware and software for lighting systems (LED light sources and LED drivers, sensors, and lighting management). It provides consultation on smart lighting controls and emergency lighting systems, light contracting, design services, and project management of turnkey lighting solutions, as well as new, data-based services focused on delivering connectivity for buildings and municipalities via the lighting infrastructure. The operating segments of the group are Lighting segment and Components segment, of which a majority of revenue is generated from the Lighting segment, The group has a business presence all around the globe.”

Source: gurufocus.com

Once again: High 60_12month long-term reversal signal, strong recent momentum, low external financing, high F-score, high Value multiple composite. The only thing which makes me flinch: The Shiller PE of 59. The narrative usually is that for cyclical companies you want to adjust the multiple by averaging the earnings/FCF/etc. of the last 3, 5 or 10 years. A high Shiller PE in combination with a low trailing PE indicates that usually the company is much less profitable and the past year was an anomaly. As a consequence, mean reversion can catch the investor off guard and the stock turns out to be a Value trap. At least that is the narrative.

However, I did not find any hard research yet which convinced me that this actually matters on a <12m time frame. I agree that buying such a stock and holding it long-term will lead to bad outcomes but that’s none of my business. I want to flip my stocks after 6 months and on this time horizon, a simple composite of trailing multiples tends to beat fancy adjusted valuation measures (to the best of my knowledge).

But don’t get me wrong: Low-vol and/or earnings stability strategies work very well. However, they tend to dilute the returns of the “Value+Profitability” component if used in an integrated multi-factor approach as the team of Alphaarchitect showed here:

Source: https://alphaarchitect.com/2019/07/30/can-low-vol-strategies-be-improved/

Kind regards,

Non-Prophet