Revisiting current portfolio: The Old Ten

Today I want to revisit my current "old ten", meaning in my current portfolio, these are the oldest 10 positions. They include Groupe Guillin, Sto, Waddell & Reed, Bastei Lübbe, Euronav, Esprinet, Dampskibsselskabet NORDEN, Solar A/S, McKesson Corp and Kroger.

It is kind of a weird time because my last rebalancing cycle was based on a 12 month holding period and ended in end of April. Now I switched to a 6m rebalancing in order to improve my Momentum capture. The challenging part: I use a "dynamic rebalancing" approach on top. I divide my 6-month investment cycle into 20 sections with ~9days each. In each of these I check, rebalance and manage one of my 20 positions. Due to the shift from 12m to 6m now, the old positions have slightly differnet holding periods until the transition is complete.

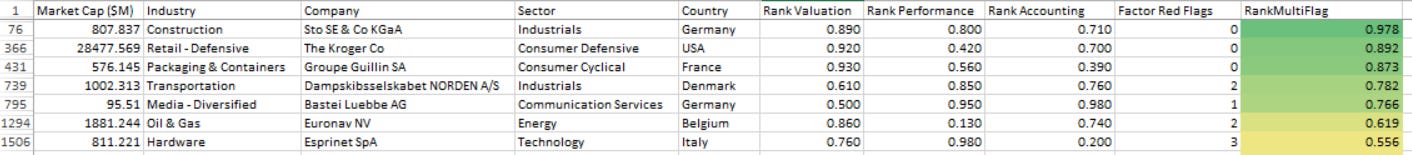

Let's first see how the 10 oldest positions play out in the newest screen and ranking:

Only 7 of the 10 made it back into the screen. The simple explanation for the 3 that didn't make it:

- Waddell & Reed got acquired.

- McKesson isn't earnings-profitable anymore.

- Solar A/S has a slightly negative Buyback Yield now.

>0 CF, FCF and E Profitability as well as >0 Buyback yield the few instant screens I apply to reduce my universe from ~12000 down to 2000-3000 stocks. So that's it.

For the others: All of them are still in the top half regarding the total rank "RankMultiFlag", almost all of them fell below rank 300 which is roughly the border of the best decile. The only exception: Sto SE, a German construction materials business manufacturing and selling especially coatings and facade systems.

In the following I want to sum up the situation in the single stocks:

Sto SE is a German construction materials business and had a good run. However, the Earnings-yield is still high at ~7% and the FCF yield is ~12% (decile 7 in global comparison). Main problems are the asset growth and accruals rank according to my screen.

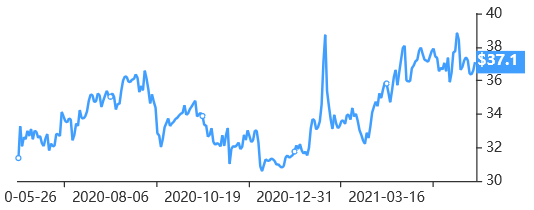

The Kroger is a leading US grocer. The main problems are worsening long-term reversal signals combined with collapsing momentum ranks. Also asset growth ranks are looking worse now.

Groupe Guillin SA is a French company engaged in producing and selling of plastic packages. Main problems are reduced momentum, worse external financing and accruals.

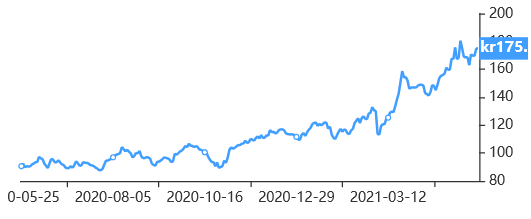

Dampskibsselskabet NORDEN A/S is an independent danish shipping company. One main problem is the bad Enterprise and Earnings multiples. More importantly however, red flags regarding debt and asset growth are kicking in.

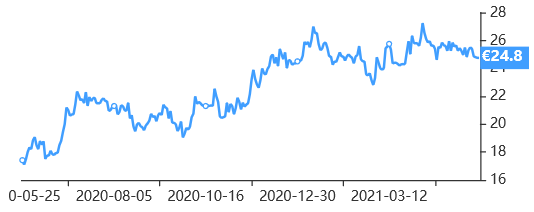

Bastei Luebbe AG is a German media company and publishing house. It is still a very good trade in accounting and momentum terms, however, the Valuation rank sank to 0.5 in the last run of the stock. Furthermore, my system applies a red flag due to currently hot 1m performance (Short-term reversal). The latter suggests, that maybe next month, Bastei Lübbe will rank higher again, although the valuation most likely will still hinder it from reentering Top-decile territory in the Buy list.

Euronav is a Belgian company which owns and operates a fleet of tankers and floating storage vessels for international maritime shipping and storage of crude oil and petroleum products. Main problems here are the bad momentum, the strong increase of sales multiples in combination with a sales growth red flag and a bad asset growth rank.

Esprinet SpA is engaged in the wholesale distribution of IT and consumer electronics in Italy and Spain. It gets the worst ranking of the remaining Old Ten, mainly based on red flags and the accounting composite. Valuatioin and Performance still look strong. However, asset growth, debt growth, external financing and general debt level punish the stock in the ranking.

Looking at this revision, bad momentum and high asset growth seem to be the main contributors to worsening ranks. High turnover and signal decay is the natur of multi-factor strategies, especially in a large global all-cap universe. This has to be kept in mind, especially regarding taxes and trading costs. From the German point of view, I find that 6-month rebalancing with high turnover is justified considering the costs, whereas 3m or 1m rebalancing would enter a dangerous territory.

Depending on risk appetite, investment philosphy and personal tax situation, the optimal preferences may vary of course.

Kind regards,

Non-Prophet.