Should you invest in cyclical industries making new highs?

I often hear from modern value investors that they exclude cyclical industries from their procedure because

a) they will always look optically cheap, especially at business cycle peaks and thus are common Value Traps,

b) they will show strong momentum late-cycle and suck in investors due to strong performance just before crashing hard.

But are those fears justified?

Value

For question a), I already had a lot of fights with different value investors in the past. It even made me doubt the premise of deep value investing at some point. I can not easily test this hypothesis on my own, so I won’t go into detail here. However, let me say that I haven’t found any evidence yet that buying cheap cyclicals is a mistake. If you are interested, here two sources about the topic of value (or factor investing in general) in different industries:

J.P. O’Shaughnessy has a whole section dedicated to sector analysis in his book “What works on Wallstreet”. He shows that on the basis of a 12-month holding period, a Value Compositie consisting of different Value multiples (P/E, EV/EBIT, P/FCF, etc.) performed very well in all major sectors.

Furthermore, here is a paper summary on why sector-neutrality does not really help you in long-only investing (https://alphaarchitect.com/2022/04/factor-investing-and-sector-neutrality/). Original paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3959116

Momentum

Fortunately, the question b) of Momentum, I can somewhat test myself using Ken-French-Data. I took the 30-industry Dataset to test the performance and average composition of a simple industry momentum strategy from 1926/07 until 2023/02. The strategy is as follows:

Each month, rank the 30 industries by their prior-12-months performance

Buy and hold the top 6 industries (Top 20%) by momentum for one month in equal weight

Repeat procedure each month

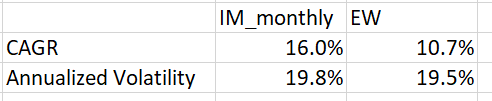

This simple strategy performed quite well vs. a portfolio always holding all 30 industries in equal weight:

The return of roughly 16% annually was achieved without increasing the volatility substantially:

So how was the average composition of the momentum portfolio? In the following you see a bar chart of the average weight of each industry over the course of whole testing period. (Industry definitions: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/ftp/Siccodes30.zip)

Please note that many industries with above-average weight are industries which are considered ugly and too cyclical nowadays:

Leisure (“Games”), Textiles, Steel, Autos, Transportation Equipment (“Carry”), Coal, Oil, Services, Business Equipment, Hospitality (“Meals”)…

Most of the time, the momentum portfolio will look crazy pro-cyclical (by defintion!) and thus scary to the average value investor. However, the data suggests that this fear is not justified. So why the disconnect?

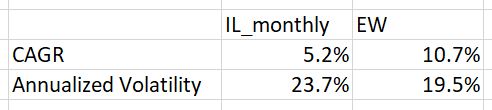

To clarify this question, let’s turn the tables. Similar to the procedure described above, I will rank the industries monthly by their prior-12-month return. However, now I will create a loser portfolio holding only the Bottom-6 (Bottom 20%) industries by momentum. The performance of this strategy is still positive but disastrous when compared to the benchmark:

The loser portfolio only returned 5.2% with increased volatility. You might ask: “Yeah but how realistic is that? Nobody buys losers waits a bit and sells them with a loss to buy new losers.” I would not be so sure about that. From own experience, I know that (Value) investors love to bottom-fish because they think they can outsmart the market. They also tend to overestimate their risk tolerance and after some losses all their behavioral biases kick in. Then the recovery comes and where the investor should actually keep holding, he is just happy about the break-even and sells. However, often the mental pain of the ride does not hold long enough to make the investor learn the lesson and he might just jump into the next bottom-fishing frenzy.

So let’s have a look what was the average loser portfolio composition:

Boom! There we have it: Textiles, Steel, Mines, Coal, … All the good stuff is overweight. However, even here most industries deviate not extremely from equal weight (3.33%). So you cannot fully blame industries alone.

My conclusion would be that people just tend to stick to cyclical businesses for too long in a downswing. They refuse to sell losers right away and hope for quick recovery. Since this behavior is much more harmful in high-beta industries, we get a lot of anecdotal narratives why you should avoid these industries altogether. After all, lessons drawn from bad experiences are stickier than those originating from good experiences (https://assets.csom.umn.edu/assets/71516.pdf).

You might argue that a momentum strategy is highly active, mentally challenging, and cost-intensive (fees, taxes). If you hold the industry-momentum portfolios for 12 months instead of just 1, the momentum will decay and you will hold a loser portfolio after all. But is that true? Again, I created a new strategy by ranking the industries based on their prior-12-month return but this time buying the Top 6 industries in equal weight based on the June ranking in July of each year and holding it for exactly one year. The results are shown in the following:

The performance is substantially reduced compared to the 1-month version, however, it still beats the benchmark without crazy volatility. Also on the composition front, there were no crazy surprises. Let’s check the loser portfolio:

The yearly version performed less disastrous than the monthly version with high exposure to coal, steel, textiles but also defensive sectors like utilities and Tobacco.

My conclusion from the yearly results is that the impact of momentum in industries matters in the short-to-intermediate-term but fades in the long run (at both extremes). But buying high-momentum cyclical industries does by far not have the disastrous mean-reverting effect some investors believe they have. Just avoid the common pitfalls (buying falling knifes) and you will be fine. Btw, I still understand why you would want to exclude cyclicals anyway. Sticking to more defensive sectors makes you sleep better and I don’t want to urge you to buy cyclicals now! However, I wanted to give everyone with doubts a perspective.

If you buy cyclicals, buy them cheap and trending and sell them IMMEDIATELY if Value and/or Momentum break. In fact, buying and holding only the most volatile (most cyclical sectors) will lead to not disastrous but nonetheless disappointing results as I will show in the next post which you find here.