If you are either a) underinvested in Smallcap Value or b) you are overweight Smallcap Value since a while and you are disappointed and about to quit: This is a small reminder for you to stay the course.

Reason 1: Value Spreads

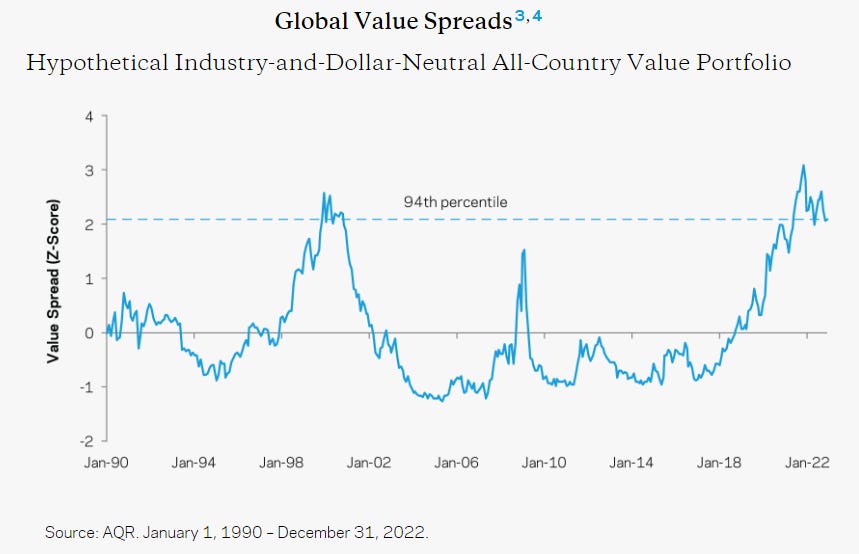

After a short victory for classic quantitative Value in 2022, we are back to craziness. With AI and megacap tech rallying again, it’s once again the oldschool Value investor who is looking the dumbest today. With many energy and transport stocks having a hickup, defensive stocks lagging and regional banks in turmoil, many classic “Value” sectors were dead weights YTD vs. the high-flyers of the Nasdaq100. So once again: Oldschool Value seems DEAD, papers on new ways to measure value are published and growth investors take victory laps. So should you finally ditch oldschool Value strategies?

Imo, a big “NO” is yelled out by Value Spreads as shown above. To put things into perspective, let’s make a thought experiment.

What IF the Value Factor (buying cheap on a set of classic multiples) was dead?

In that case, the signal would become noise.

How does that happen?

The historic overestimation (underestimation) of future growth for expensive (cheap) stocks would need to fade, so that the average realized future return (yield + growth) matches.

How would we achieve this?

Way better forecasts (or invention of the magic crystal ball).

In the past, Value Investing basically lived from rather consistent disappointment from high expectation stocks and positive surprises from low expectation stocks. If this relationship fades, we should (in my opinion) achieve a rather stable value spread creating an equilibrium between high-yield low-growth stocks and low-yield high-growth stocks. However, that would also mean that human nature needed to change.

Many Value investors (me included) will admit (in hindsight) that largecap glamour including Apple etc. was way too cheap until 2016. The Value spread would support this. However, we went all the way to dotcom bubble extremes for many stocks since then. In a world, in which growth companies constantly grow into their multiples, there would be not much multiple expansion. But the opposite was the case. Instead we see future earnings expectations pulled forward into the present AFTER a strong growth period. A clear case of overextrapolation.

The following graph shows that analyst forecasts for glamour and value stocks are directionally right in general. However, growth expectations (positive and negative) are overblown most of the time as the future is more random than expected and extrapolation has its limits:

As a consequence, a fabulous high-quality company which grows steadily can be a terrible investment if it is too expensive. Unfortunately, timing the exit is almost impossible. See Microsoft as example:

So? Don’t abandon Value here to FOMO into Glamour.

Reason 2: Smallcap opportunity

The Value spread basically shows us “The current Value of Value”. Similarly, we can look at the “Value of Size” by checking different stock indices and their multiples.

The S&P 400 (Midcaps) and the S&P 600 (Smallcaps) are near 2009 and 2020 crysis valuation and which in both cases was followed by violent SMIDcap rallys. While the S&P500 is not at a crazy expensive valuation as a whole, it seems rather unattractive in comparison. Please note that Quality (often) matters in Smallcaps. That is also the reason why there is a wild difference between the Russell 2000 and the S&P 600, which has a profitability criterion:

Even though, it did not matter much over the recent decade. In this comparison you see SLY, IWM and for context RZV in comparison:

Reason 3: Mean reversion

A well-documented effect in country, industry, factor and “size” portfolios is the long-term reversal effect. In a collection of somewhat diversified, robust subsets of the market (e.g. different sector portfolios), the long-term loser (winner) portfolio over the past 10+ years tends to be the winner (loser) portfolio of the next 10+ years. While it is a truly terrible timing rule, this concept also gives us hope just in case that Smallcap Value really is dead.

Because what does “Dead” mean? “Dead” does not mean that the signal completely reverts long-term and you should only buy the most expensive stocks from now on. “Dead” means that a signal vanishes and becomes noise in a more efficient market. That would tell us that Smallcap Value and Largecap Glamour should have the same long-term risk-adjusted return. However, that also means that both asset classes should mean-revert after a prolonged performance discrepancy.

Don’t get me wrong. There is a huge random component here and betting on mean reversion in a random game is basically the definition of the Gambler’s fallacy. However, I strongly believe that markets are not entirely random. There are limits to growth, scalability and the capacity of asset classes. The fundamental value of companies acts as an “anchor to reality” for stock prices which does not exist in this form e.g. within Roulette where each new game is independent from the previous one. And there is also human psychology.

So does that mean that Smallcap Value will outperform in 2024? No! We are talking decades here, as the next graph illustrates:

The chart also shows a major danger to “quitting” Smallcap Value. Most of the time Smallcap Value is just a noisy version of the S&P500 (or the MSCI World for global scale). Basically, all the outperformance since the 1930s came from 4 periods with a length of 3 to 7 years followed by decade-long mediocrity. Quitting due to recent underperformance and missing the following rally can make or break your whole investing career. Especially now that valuation spreads within Value and Size are at extremes.

Conclusion

If you are invested in Smallcap Value, stay the course. If you aren’t, consider getting in before it’s too late. The permanent downside is limited. You might experience a deeper (short-lived) drawdown in a global liquidity event like 2008 or 2009. You might end up with a slightly noisier S&P500 if Factor Investing is dead for good. But the potential upside is worth the risk in my opinion. (As always that is not investment advice.)