US microjunk

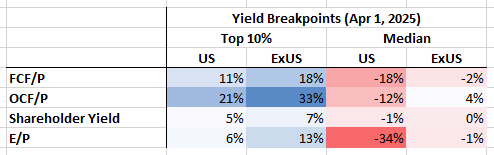

Today I checked my cyclical microcap universes with the Portfolio123 X-Ray tool to see the Median and Top10% breakpoints of common yield metrics. The goal of this exercise was to get a quick comparison of my cyclical US and ExUS microcap universes regarding their value rank distribution.

Both universes have the same base settings:

North Atlantic Primary

Median daily volume (50 days period) > $25000 (to eliminate the most illiquid names)

Exclude Financials, Utilities and Staples (different behavior from other sectors)

No OTC

No exotic/autocratic exchange countries (e.g. RUS, TUR, HRV, …)

Market Cap Rank < 75 (roughly < $1B)

Then, I separate into US companies for the US universe (1477 stocks) and exUS companies for the exUS universe (1912 stocks). Of course, there's no full comparability in the sampling but it should give us a rough overview about the current landscape.

Via the P123 X-Ray tool, I then checked the stock list of each universe according to my value rankings and looked up the approximate breakpoint yields at the 90 Rank level (Top 10% breakpoint) and the 50 Rank level (Median breakpoint).

The results are as follows:

Imo, it is safe to say that the US universe contains much more junk. The median yields are disastrous. Buying the median US microcap gives you an highly unproftiable, diluting company. Now imagine buying a sub-median US stock.

In exUS markets, the median yield is not pretty either but at least you get operating cashflow profitability, no dilution and a “red zero”.

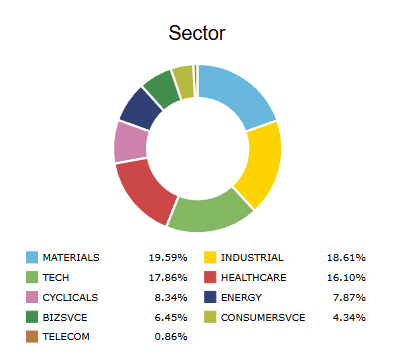

The elephant in the room of course is the industry composition:

US:

ExUS:

Still, both universes backtest similarly if I concentrate on extreme value+mom stocks. US top 10% breakpoints look more expensive than exUS but not disastrous. And they are well worth the diversification benefit.

The lesson:

Imo this shows how important it is to focus on the "best" microcaps and not just buy broad small and micro ETFs like IWC 0.00%↑ or IWM 0.00%↑ and call it a day. The death of the US size premium does not sound so crazy after seeing such numbers.

So, you really have to dig deeper (whatever that means to you and your strategy) to make a difference. Buying and holding a broad Small/Micro index will inevitably leave you with a lot of bad apples.

My conclusion for microcap investing: Go all the way or go not at all.

PS: Industry compositions including financials, utilities and staples

US:

ExUS: