Why I do DIY multifactor microcap investing #1 - Concentration

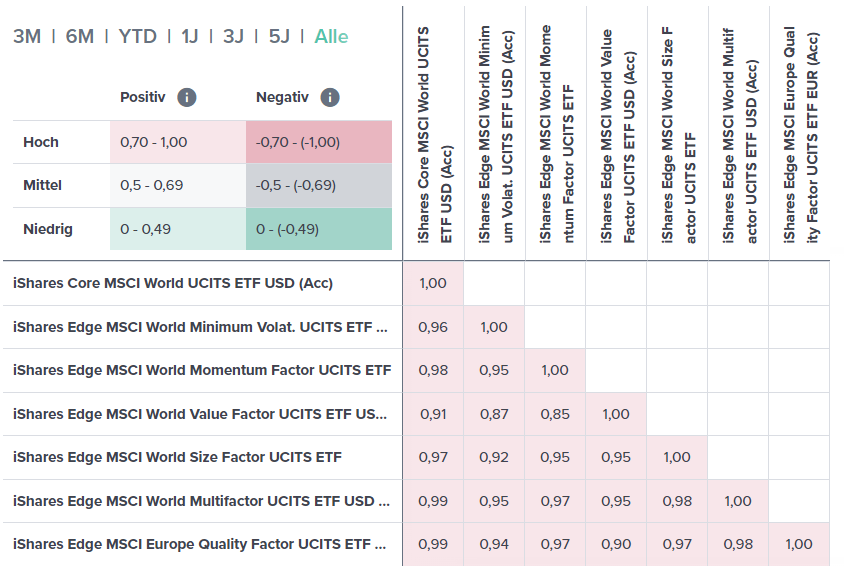

Factor ETFs can give you first exposure to Value, Quality, Size and Momentum. But is it enough? Most of these ETFs only give you a somewhat diluted factor experience since they contain 100s of stocks and are mostly marketcap-weighted. As a result, the correlation to the market is often high as shown in the correlation matrix below.

Except for MSCI World Momentum, all broad MSCI factor portfolios underperformed the classic benchmark recently. Don’t get me wrong. I don’t want to say that lack of concentration was the reason for the underperformance of most factor ETFs. Factor investing had a bad decade. However, to really profit from the (inevitable) recovery of Value and Co., concentrated portfolios should be considered.

For Value, the historic return was clearly dependent on the holding period (or rebalancing/reconstitution frequency) of the portfolio and the number of holdings:

For Momentum, the effect is even more dramatic:

Will there be higher tracking error and higher volatility? For sure. But in my opinion the fear of higher risk is overblown if you surpass 20 diversified global stocks. Plots like the one below show that the benefit of diversification is often quickly reached by adding more stocks. At a certain point you will “diworsify” your stock portfolio by reducing returns without reducing risk. Of course, take these numbers with a grain of salt. For a portfolio of global conglomerates, the balance can be achieved with maybe 5 stocks already. With a sector-concentrated US-only microcap portfolio, you might need 50 stocks. But the general concept and the approximate range should be about right.

In my personal opinion, having “too many stocks” in a single-factor portfolio isn’t even that big of a problem. But I like to get the highest exposure possible, so why only use one factor? If you integrate multiple factors into your stock selection (this will be a story for another blog post in the future), the question of concentration becomes dramatic quickly. Imagine a 10000 stock universe and a world where every factor signal is perfectly uncorrelated. You want to invest in the 10% cheapest stocks. You have 1000 stocks to buy. Great!

Now imagine you only want microcap value stocks, so let’s say the smallest 20%. You have 200 stocks left. Should they also be in the Top20% by momentum? Ok! You have now 200 * 0.2 = 40 stocks left. And you also created a quality screen to screen out the 50% with the worst balance sheets and profitability? No problem! 20 stocks left… Concentration works best together with multifactor integration. Maintaining high exposure to all applied factors requires concentration by nature. And if you build a concentrated portfolio anyway, why should I not exploit this?

Now the best part:

The big guys can’t follow you there. Marketing teams use the opportunity to sell the idea of factor tilts in “save” large and megacap universes while maintaining a portfolio of 100s of cap-weighted stocks with the idea of “diversification” and lower risk. They might also say that customers don’t want too high tracking error (deviation from the broad market) in order to stick with the strategy (which is somewhat viable, but seriously: “no pain, no gain”). However, in reality there is one major reason: scalability and capacity! The smaller the total market capitalization of the portfolio (either due to small/microcaps or due to low number of holdings), the lower the capital which can be squeezed into the strategy without having too much market impact or exploding costs due to other sources of friction.

(This already brings me to another point: Small- and Microcaps. However, this will be a topic for another day)

Nice write up and I do the same including some made up qualitative factors: https://www.detrituscapital.com/small-illiquid-unknowable/

One comment on the benefits to diversification though — there’s a common misconception about what is diversified away. Your ‘risk’ is defined as volatility of returns (lumpiness month to month) which does decay around 15-30 stocks. However what decays much more slowly is how different the returns of a 25th percentile lucky vs a 75th percentile lucky portfolio is, when you increase the number of stocks in a portfolio. In other words, you do not diversify single stock risk until you have something like 50-100 stocks. This paper is the only place I’ve seen this discussed: https://ndvr.com/pdf/documents/NDVR-HowManyStocksShouldYouOwn-November2022.pdf