Why I do DIY multifactor microcap investing #2 - Size

There are many reasons why most financial products, funds and portfolios are restricted to owning largecaps:

Scalability (you can’t ram billions of dollars of AUM or personal wealth into a microcap portfolio due to friction, illiquidity, capacity and market impact; as a consequence, small- and microcaps are ignored or talked down, especially after a golden decade for largecaps like the one we just had)

Fear (Small and Microcaps as a whole often appear more fragile, lower-quality, unknown, etc.; this is supported by horror stories about penny stocks, e.g. of the uncle who lost it all in past biotech and mining manias)

Unsexiness (you can’t brag at the dinner party about your boring, ugly regional paper distribution microcap when your neighbor is talking about his latest investment in Tesla stock)

Career risk (it is better to fail conventionally than to succeed unconventionally; your customers or bosses will give you a tap on the shoulder if you identified a microcap multibagger but they will fire you if you own microcap industrial shitcos in a financial crysis; “Nobody gets fired for owning Apple”)

Others (margin requirements, intransparency, lack of information, …)

Most of these reasons are no problem for a willing retail investor. Instead they provide chances to make a difference. Of course one might just get access to the space by simply buying an ETF like IWC. However, in this case, you will buy a cap-weighted volatile junk basket with a lot of unprofitable names (see P/E in the following overview). So you should be a bit more selective.

A good example to get more selective access to small- and microcaps is the Roundhill Acquirers DEEP Value ETF (DEEP) with a median holding marketcap of $800 million and a median EV/EBIT of 8.2x. The focus on valuation multiples for stock selection naturally requires fund holdings to be somewhat profitable which is one of the best starting points to tame the junky microcap space.

In the US and Canada, there are a lot of other boutique ETFs which do an excellent job in giving you a vehicle to ride the small/microcap value train. As mentioned in the previous post, integrated multi-factor strategies are rarer, especially in this size bracket (feel free to correct me in the comments or give examples for small/microcap multi-factor funds). Factor integration will get its own post in the future.

Another personal problem for me as a German retail investor: I am restricted to UCITS ETFs. Thus, most excellent US boutique ETFs disqualify because I don’t have access. Most workarounds are too tax-inefficient or expensive for small retail accounts. I only have access to one US and one EU value-tilted smallcap ETF with holdings up to over 10 billion in marketcap. To my knowledge, there is not a single UCITS microcap ETF available. “Access” and UCITS funds will also get their own post in the future.

So here I am. Craving a multifactor microcap portfolio without having proper low-cost access. However, is this really necessary? Are small- and microcaps really that much better?

Let’s have a look into the Kenneth R. French data library (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html). In the following, I plotted the annual raw and risk-adjusted returns of 5 factor sort buckets (quintiles = 5*20%, sorted monthly) which were separated into 5 size buckets by marketcap in the next step. I labelled the 5 size buckets “microcap”, “smallcap”, “midcap”, “largecap” and “megacap” accordingly. The size categorization methodology by Fama/French is a bit cryptic but to get a rough idea, we can look at the average marketcap of each size bucket denoted in their datasets as of February 2023:

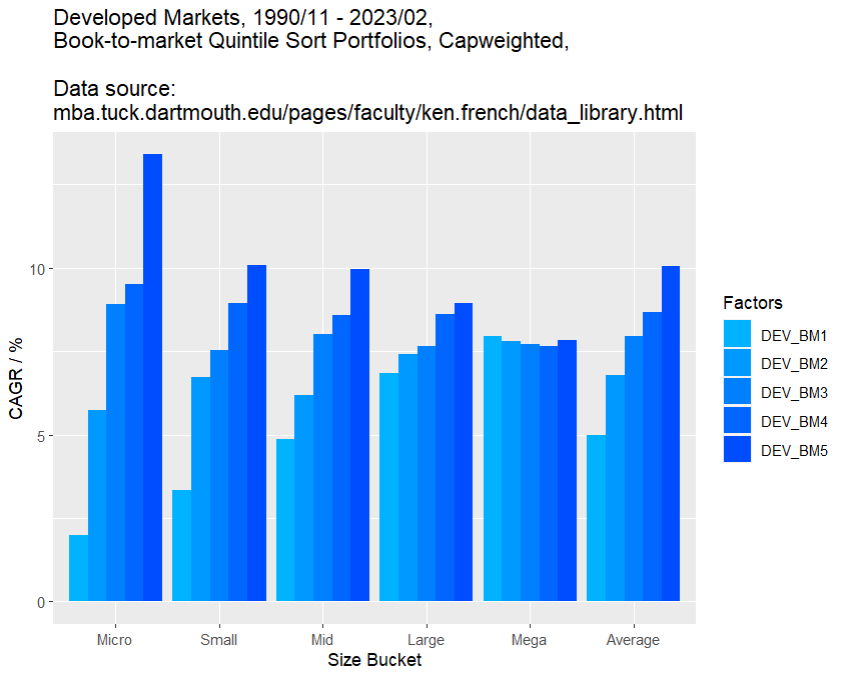

Following the ME breakpoint dataset on top, the current breakpoint between Microcaps and Smallcaps should be in the area of $750 million. Now that we clarified the categorization, let’s look at some return data for 12_2-month momentum and book-to-market sorts. I will use cap-weighted results to dampen the effect of illiquid nanocaps in the lowest size bucket, which are even hard to trade for very small retail investors (high spreads, low volume). Furthermore, I start in 1990 because the developed markets data does not go not further back (also in the pre-computer age, smallcap information was naturally rare, so returns might be overstated).

Developed Markets momentum sort portfolios, CAGR:

Developed Markets momentum sort portfolios, risk-adjusted returns:

Developed Markets book-to-market sort portfolios, CAGR:

Developed Markets book-to-market sort portfolios, risk-adjusted returns:

Notably, Size acts as an amplifier for almost all common factor sorts, also the ones not shown here (CF/P, E/P, stock issuance, low volatility, investment, …). Also, the borders of size/factor performance are fluid (but gradually decaying) up to marketcaps of approxiamtely 10 to 20 billion dollar. As soon as we enter megacap land, some factors did not work as intended over the last 30 years. This might revert in the coming decade but I wouldn’t bet on it. There are strong arguments suggesting that large- and megacap pricing became very efficient as a whole. Finding true mispricings in this bracket will most likely depend more on qualitative factors instead of quantitative ones going forward. Why should I play this game where my opponents are banks, funds and capital allocators with unlimited resources?

I rather hunt in the small- and microcap jungle where low capacity, career risk and unsexiness are major tailwinds for persistent anomalies. Passive investing and the recent largecap frenzy might lead to ongoing ignorance against smallcaps. However, smallcaps are already historically cheap and the value spread is historically wide. At some point, a good deep value smallcap becomes so cheap that it pays out your investment in dividends and buybacks alone, gets acquired with a premium by competitors or gets “unlocked” by eager activists.

I believe that farming the size/multifactor interaction to the fullest is only possible if I do it on my own. That might be dumb. Only the future will tell. But I will try.