Can Long-only Industry Momentum Portfolios be improved by excluding certain industries?

After we looked at some industry-momentum decompositions and B&H strategies of cyclical, sensitive and defensive industries, I now asked myself:

If we exclude certain “problematic” industries from the equation, could we even improve the returns of a momentum strategy?

The idea behind this would be that certain industries live through short and very volatile subcycles which would lead to increased whipsawing when moving into and/or out of them. For example, commodity-sensitive companies would come to mind.

Here again the simple stats for a monthly reconstituted Portfolio of the 6 industries (of 30) with the highest 12-month momentum (IM) vs. an equal-weight portfolio of all 30 industries (EW):

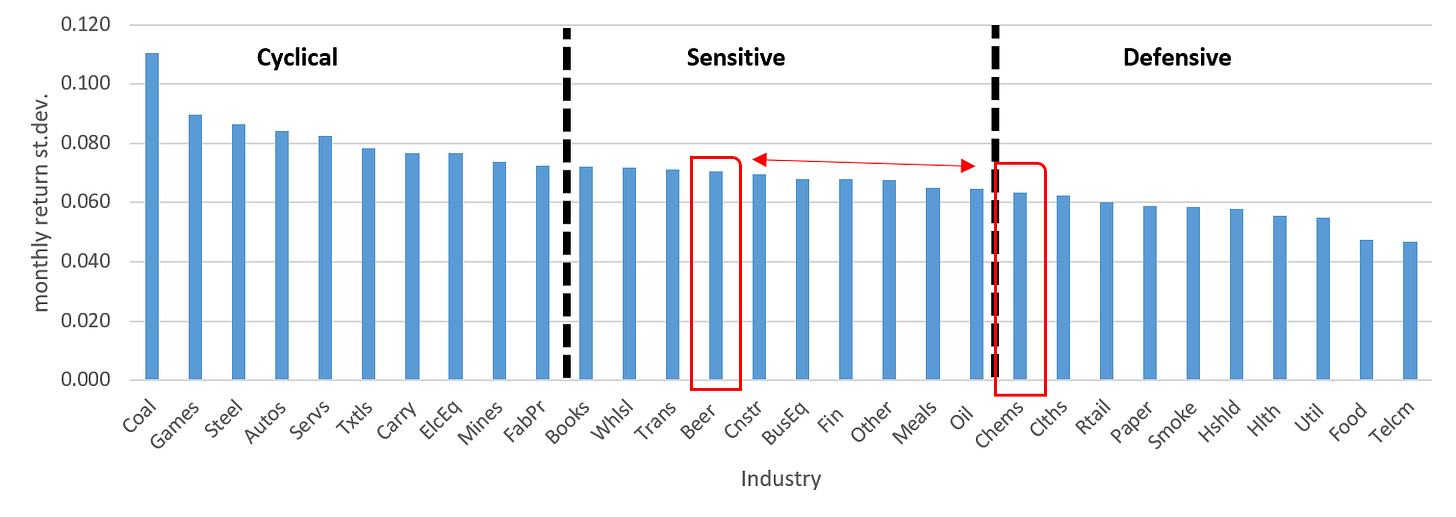

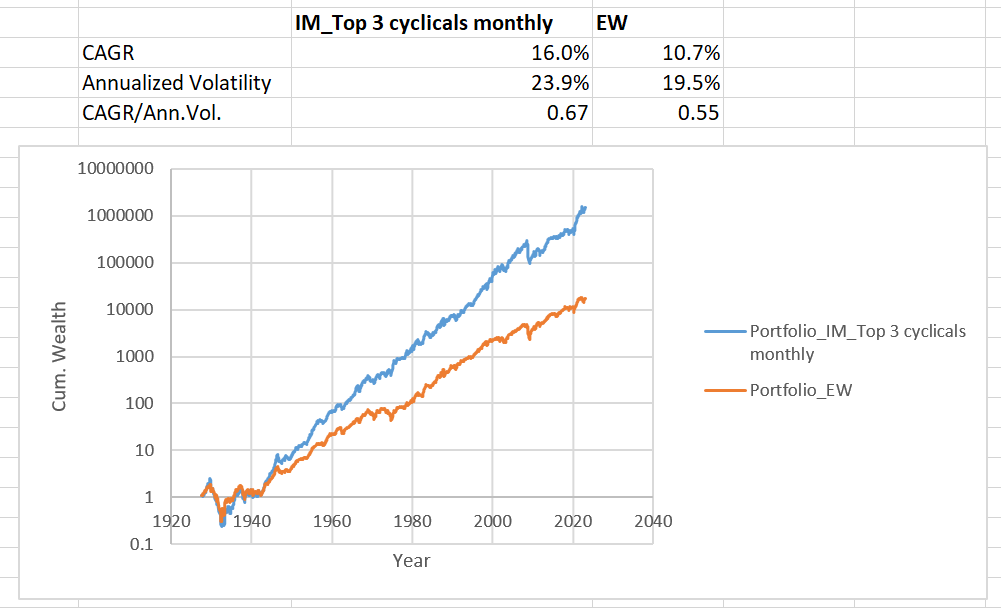

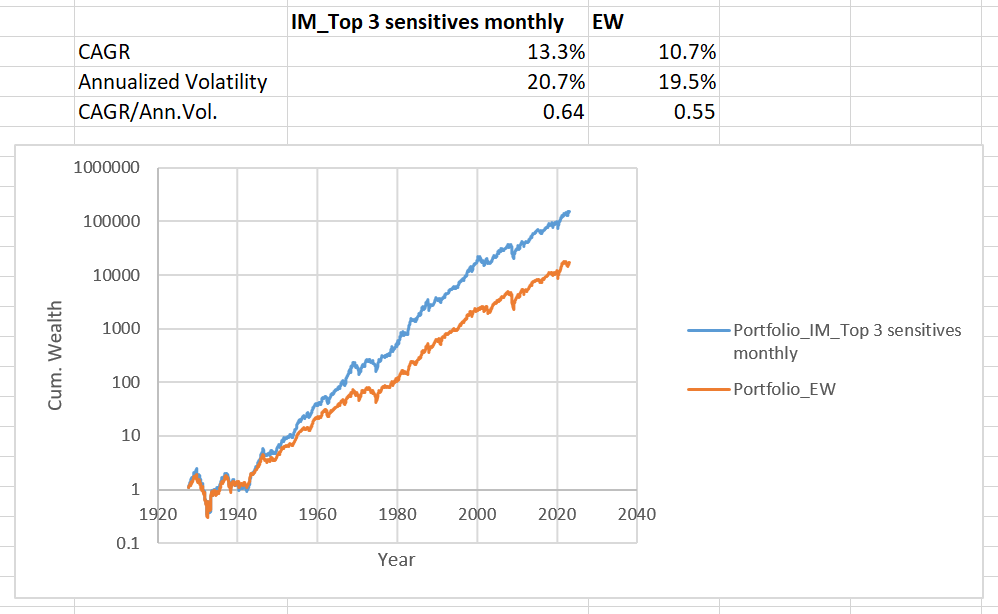

In my last post, I categorized the 30 industries into 3 groups of 10: cyclical, sensitive and defensive. Let’s have a look how momentum strategies worked within these closed groups. Due to the reduced number of industries in one backtest, I also reduced the number of top industries held at each time to the Top 3 (instead of Top 6). Here are the results:

Categorization:

Cyclicals:

Sensitives:

Defensives:

As we can see, momentum strategies outperform the market in all 3 groups. Cyclicals with momentum produced the highest raw return, whereas defensives with momentum showed the highest risk-adjusted returns. Sensitives were inbetween.

In a last step, I naively try to solve for the best inclusion/exclusion of single industries from the process to improve the performance using an evolutionary algorithm (EA) method in Excel Solver. For this procedure, I go back to choosing the Top 6 industries to form each month’s portfolio. Also, as a boundary condition, at least 15 of 30 industries should stay included in the universe. Of course, the result is strongly datamined and should be taken with a grain of salt. Here is the result if I solve for highest risk-adjusted returns:

Compared to the original 6-of-30 industry momentum portfolio, we were able to add another 1.4% of CAGR without higher volatility. Solving for max CAGR delivered the same results. So which industries were excluded in this model?

Food

Consumer Products

Utilities

Construction

Services

Transport

Others.

The former three industries are very defensive sectors which might drag raw return of the portfolio down. Also the strategy might pile into these defensives at the worst time like for example at the bottom of 2009. The other excluded industries might have too many correlated better alternatives to add value.

Conclusion

So this naive approach actually suggests that we should exclude some of the most beloved quality sectors (consumer goods and food) from our momentum strategy. Of course, again, this is highly datamined and not at all robust. Also, compared to the vanilla 6-of-30 industry momentum strategy, the “improvement” seems marginal.

If anything we could conclude that we should include all industries when looking for momentum, no matter the current narrative on the hated or beloved, beautiful and ugly parts of the market. Nonetheless, you “could” exclude certain ugly industries for personal reasons. I don’t blame you. But in a momentum rotation strategy, there seems to be no certain hot industry which will be your doom if bought as long as you follow a disciplined rules-based approach.

One might also consider buying and holding defensive stocks with one part of the capital and trading a momentum strategy in cyclicals+sensitives with the other part.